How the United States Gained Control of the Global Monetary System: part three

Stage 3 - The 1971 Nixon Shock

free, text

Stage 3

1971 Nixon Shock

Summary of Key Points

- The fiat dollar is born

- Removing the link to gold allows for infinite expansion of the money supply and money creation no longer has any restraints

With the Federal Reserve system now in place and the U.S. dollar firmly established as the world reserve currency, the United States had already achieved substantial control and influence of the global monetary system and in world affairs more broadly. Washington’s grip on the global monetary system would be further consolidated by the final stage, the Nixon shock.

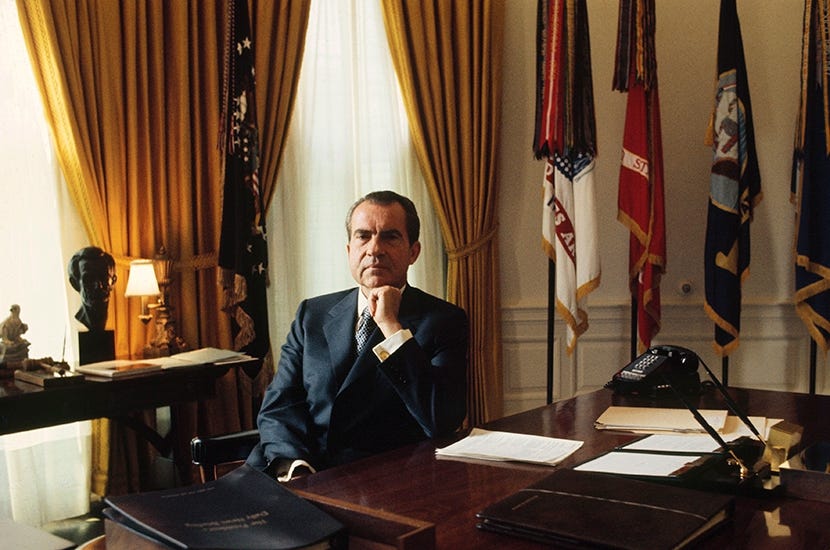

The Nixon shock was a landmark event that occurred in August 1971 whereby President Richard Nixon decided that the dollar’s link to gold would be removed, abolishing the direct convertibility of overseas U.S. dollars into gold. As a result of this decision, the Bretton Woods system had come to an end and the fiat dollar was born.

Removing the gold peg meant that the United States no longer had any obligations to the broader international community as far as monetary matters were concerned: new dollar bills could be brought into circulation, essentially by decree. This was not possible prior to the Nixon shock because Washington was, to a large extent, constrained by the obligations laid out at the Bretton Woods conference; some monetary inflation was possible but excessive money creation (whereby they could just print all the units of currency they wanted) was limited by having to maintain the dollar to gold equilibrium and America’s obligation to guarantee that dollars could be exchanged for gold on demand. Removing the gold peg changed all that; henceforth, it allowed the U.S. government to pursue previously inconceivable, undisciplined fiscal policies of borrowing and spending, both at home and abroad, in the pursuit of empire as well as allowing the United States to inflate away the existing balance of payments deficit that was the direct result of overspending by previous administrations (Nixon’s included). Effectively, this decision allowed for infinite expansion of the money supply which, for the United States, meant a significant extension of both American power and the Federal Reserve system.

There was a moment where American hegemony was called into question and the American empire was teetering on the brink of collapse. Rising unemployment and inflation domestically, mounting pressure from the international community to devalue the dollar, the emergence of Mao’s China, the war in Vietnam, increasing competitiveness in the global economy, and the ongoing Cold War with the Soviet Union all collectively threatened to undermine U.S. supremacy. However, removing the gold standard while the dollar was still the world reserve currency would, over time, go on to be a masterstroke by Washington on the grand chessboard of geopolitics as the advent of the petrodollar system along with an expanded market for U.S. debt securities created an artificial demand for dollars around the world that allowed the U.S. to print and spend all the fiat dollars required to assemble the military infrastructure it needs to sustain and grow the American empire; funding research and development into new weapons technology, building military bases abroad, providing subsidies to the military industrial complex, and, of course, funding wars. It is no exaggeration to say that the American empire was built on the back of the fiat dollar.

Even though the entire world moved onto a pure fiat standard only the U.S. was allowed to engage in excessive levels of printing, borrowing, and spending because ultimately only the United States can issue the world reserve currency freely, the U.S. dollar, whose value only Washington (by way of the Federal Reserve) can determine. A similar point was made by France’s finance minister and future president Valery Giscard d’Estaing at a meeting in Paris shortly after the announcement by Nixon: d’Estaing realised early on that removing the last remaining constraints on money creation meant that the U.S. could engage in unrestrained monetary policies as a result of the dollar’s central position in the world economy. It gave America an unassailable advantage over other countries who had to act with more restraint and discipline in monetary affairs.[10] Demand for the dollar and for U.S. treasuries and bonds is effectively permanent, this demand keeps interest rates low enough for the United States to borrow and spend all the dollars required to expand its empire as Washington deems necessary.

And what of America’s empire now? The United States has 750 military installations in over 80 countries around the world, it plays host to the most formidable military in history, it has a nuclear arsenal consisting of 6,450 warheads and it has 173,000 troops deployed around the world. Lastly, the U.S. can grant billions of dollars in subsidies to corporations such as Boeing, Raytheon, and Lockheed Martin for military contracts. It is my upmost contention that without the fiat status of the dollar, the composition of the U.S. empire would be vastly different and so would the balance of geopolitical power in the world today. More gold or other precious metals do not have to be mined for new units of currency to be brought into circulation, essentially new money is created out of thin air and is then used to assemble this vast military apparatus.

The relationship between war and the fiat system cannot be ignored either. Under a gold standard, governments can only pay for war either by raising taxes or by selling war bonds. If you actually have to part with physical gold to pay for bombs and munitions, to pay for soldiers’ salaries, to transport all the heavy machinery then you will quickly run out of gold and the capacity to wage war is greatly reduced. Transitioning to a fiat system enabled the U.S. to finance empire building by printing money; as a result, spending on military and war was no longer constrained by monetary obligations like those outlined at the Bretton Woods conference. [A] By the time it had concluded, the Vietnam War is estimated to have cost $168 billion (equivalent to $844 billion in 2019 dollars and $1.47 trillion in 2021 dollars) so Graeber may indeed have a point. Similarly, a report commission by Brown University estimates that between 2001 and 2022 the United States spent over $8 trillion on its post-9/11 military engagements.[13] This is all enabled by having a floating, fiat currency that has no solid, metallic base to it; if we a had a gold-backed currency that needed to be maintained by governments and central banks alike then the huge expansion of the monetary supply required to wage these wars and construct the military capacity required to sustain the American empire would simply not be possible. This point cannot be stressed enough.

There is another interesting development that transpired as a result of the Nixon shock. Having a totally elastic, floating currency paved the way for what I have come term as finance capitalism; that is, a complete change in the structure, direction, and output of capitalism in the developed world. With easy access to cheap, liquid capital, financial institutions could now enter largely deregulated markets ripe for investment and speculation. The result is that banks and other lending institutions have a new found prominence in the global economy, a direct consequence of the growth in informal lending institutions, a rise in speculation, and the advent of the shadow banking system. The shadow banking system accounts for approximately $52 trillion worth of trade annually, many times more than trade in actual goods and services. These developments amount to a significant extension of the global American empire, providing new markets for the dollar to circulate in, increasing its liquidity in the process, ultimately consolidating the U.S. dollar's position as the world reserve currency. The flip side of this is that major private, commercial U.S. banks and other financial institutions hold considerable influence in the world today and can advance U.S. interests abroad as such. For reasons of practicality, I have chosen to keep this point relatively brief but I cover this subject in more depth in The Nixon Shock: part two.

The Nixon shock was a fait accompli for the United States. Neither Congress nor the international community were consulted about the decision. Transitioning to a fiat system enabled the U.S. to finance empire building simply by printing money and, as a result, spending on military and war was no longer constrained by the monetary obligations to the international community. As well as moving the entire world onto a fiat standard, the decision meant that America could now, quite literally, outspend its rivals in pursuit of empire and expansion. The birth of the fiat dollar was the birth of the modern world.

Click here for parts one and two of the Nixon shock.

Conclusion

Over time, the United States would go on to add further layers to the dollar system, developing highly liquid financial markets, such as the petrodollar trade, an expanded market for U.S. debt securities, the Eurodollar markets abroad, and finally with the dollar being used as the main pricing mechanism for commodities; this has gradually led to a self-reinforcing cycle of monetary and financial dominance that still exists today and is arguably stronger than ever.

By 1971, the entire world economy was effectively remade forever. This system has survived numerous geopolitical realignments, the rise of China, the introduction of the euro, the two oil shocks of the 70s, global pandemics, the Great Inflation, war, terrorism, the 2008 global crisis, and more. Control of the monetary system is arguably the most enduring component of the American empire.

Without control of the global monetary system, the entire landscape of geopolitics would be different as the structure and composition of the American empire would not be what it is today without the central role of the U.S. dollar. The balance of power in the global economy would also be radically different as well; control of the monetary system is precisely what allows the U.S. to assume the dominant position in the world economy.

Today, with trillions of dollars traded daily in global markets it is no understatement to say that world trade, international finance, and the global economic system all revolve around the U.S. dollar.