How the United States Gained Control of the Global Monetary System: part one

Introduction; Stage 1 - The 1913 Federal Reserve Act

Introduction

In this series I will attempt to explain how the United States gained control of the global monetary system, at least as this humble author sees it. The monetary system is, at its core, a dollar-based, central bank controlled, fiat monetary system (I refer to it simply as “the dollar system”), it was constructed over the course of the twentieth century and revolves around three central events, these are:

The 1913 Federal Reserve Act

The 1944 Bretton Woods Conference

The 1971 Nixon Shock

This sequence of events handed the United States control of the global monetary system, providing the foundations for the American empire along the way. Understanding these events is key to understanding the evolution of the American empire and how the U.S. has become the uncontested superpower in the world today.

Control of the monetary system is what gives the U.S. an unassailable advantage over its geopolitical rivals. It is my firm belief that the two main components of the dollar system are, 1) the world reserve currency position of the U.S. dollar and, 2) the dollar’s status as a fiat currency. The primary, central authority that oversees all of this is the Federal Reserve.

Interim developments that take place between these three events have been omitted. I refer to the two world wars, the Treaty of Versailles, the decline of Europe’s empires, and other developments that, while obviously very important, bringing about geopolitical realignments in favour of the U.S., were not, in themselves, solely monetary affairs.

I would also like to add that this series is not necessarily a full, comprehensive account of each of these events; it is primarily concerned with monetary affairs and how these developments helped construct the dollar system. I will link readers to the dedicated articles on the Bretton Woods conference and the Nixon shock which provide a more complete retelling of those events.

Stage 1

The 1913 Federal Reserve Act

Summary of Key Points

- The Federal Reserve system is born.

- The U.S. finally has a centralised system for the issuance of its currency.

- The banking system becomes monopolised by private, commercial banks.

The Federal Reserve is the central bank of the United States of America. It issues the U.S. dollar, which happens to be the world reserve currency. The Federal Reserve is the most powerful institution in the world today, arguably the most powerful ever: this is because it has total and absolute control to set value within the economy (this includes the value of goods, services, assets and even labour itself), and this goes a long way in determining market conditions as such, because the Fed controls the supply of the dollar which no other institution can do as the Federal Reserve has a monopoly on money creation. It is important to understand that the global economic system is pyramided on top of the central banking complex however, as the U.S. dollar is the world reserve currency, this gives the Federal Reserve (and by extension the United States) the superior, dominant position in the global economy ahead of other central banks. For the United States, all of this translates into tremendous power and leverage in world affairs.

Central banking is a somewhat tricky topic as it takes place beyond the purview of the citizenry - although it affects us all. The overall point I wish to convey in stage one of this series is that the central banking complex wields tremendous power over the global economy; through collusion and by employing a variety of financial practices, the central banking complex is the very foundation of the global economic system that we have today. Within this paradigm, the Federal Reserve exerts the most influence and control. This article is an overview of the Federal Reserve system; its structure and its main practices. The modern central banking complex is modelled on the Federal Reserve system; this is precisely why the 1913 Federal Reserve Act is such a pivotal event in world history.

The 1913 Federal Reserve Act enacted into law the cartelisation of the United States’ money supply by the big banking houses: the banks got control of the money supply (which was now in the hands of wholly private interests) and in return the government got access to cheap, liquid capital. Central banks are essentially a monopoly of the big private, commercial banks who all coordinate and work together under one, centralised unit. The board of directors at the Federal Reserve comprises of representatives from all the major banks. Central banks do not act in the best interests of the people, they act in the best interests of their board members.

As the twentieth century got underway, America still did not have a banking system to rival the centralised banking systems in Europe such as the German Reichsbank or the Bank of England. The U.S. banking system was, at the time, plagued by instability having been beset by numerous banking panics, most notably the panic of 1907. The elite bankers and financiers knew that if they could launch a central bank modelled on what Europe had it would afford them complete control over the monetary affairs of the country. Naturally, a more liquid currency would follow and this would, in turn, make the United States more competitive in global markets, allowing them to compete with the major European powers who had stronger currencies and better centralised banking systems.

In 1910, a historic meeting at Jekyll Island, Georgia, brought together representatives from the major banks at the time. These included Frank Vanderlip (president of the National City Bank of New York), Henry P. Davison (senior partner at JP Morgan and Company), Paul Warburg (partner at Kuhn, Loeb & Company), Benjamin Strong (vice president of the Bankers Trust of New York) and Charles D. Norton (president of First National Bank of New York).[1] Virtually all the attendees were in either the Morgan or Rockefeller gambits, furthermore it is estimated that those in attendance represented one quarter of the world’s total wealth at the time. Paul M. Warburg and Nelson W. Aldrich are widely regarded as the founders of the Federal Reserve system. That the Assistant Secretary of the Treasury, A. Piatt Andrew, was in attendance is also very telling. After some delays, the act was finally signed into law in December 1913 by President Woodrow Wilson.[2]

Currently, however, who owns the Fed’s stock is a highly ambiguous issue, shrouded in secrecy, as numerous mergers and acquisitions through the years make it hard to trace who owns the stock in the Federal Reserve. The Federal Reserve is a wholly self-governing institution and a totally undemocratic one at that. Its decisions do not have to be ratified by either the President or any other government department, it has no accountability to outside parties. The issue of auditing is a highly contentious one with conflicting reports as to who audits the Fed and how impartial these audits truly are.

Cartelisation is the single, most fundamental component of the Federal Reserve system. At the time, the United States was dominated by strong cartels in railways, steel, oil, and other industries too and this strongly influenced how the elites conceived of national banking. The Federal Reserve system, and the broader central banking complex throughout the world, is a nexus between the big commercial banks that all work and coordinate together under one central, overarching authority that has absolute control over the means to exchange goods and services and to set value within the economy. The creation of the Federal Reserve meant that a select few were now in control of the nations’ banking system and money creation, whilst at the same time being walled off from traditional free market competition.[3] This system allows the commercial banks to collectively expand and contract the money supply together, ensuring that one bank is not more exposed to market volatility than another and ensuring that one bank does not lose its reserves to another.[4]

Central banks control the value of money by controlling both the supply and the interest rate, essentially by diktat, as such they can dictate large segments of the global economy as a result. They can grow and contract the money supply by decree and can inflate away the value of our money as well, either by monetary inflation which involves bringing new units of currency into circulation (sometimes called “quantitative easing”) or by setting the interest rate lower than the rate of inflation (called “financial repression”). In the aftermath of the 2008 global economic crisis, the 7 year long zero percent interest rate policy employed by the Fed led to banks using this cheap credit to create dangerous speculative asset bubbles.

As well as being able to determine the value of money, the Federal Reserve also gets to determine the level of liquidity (the volume of money) in the global economy as well. This is highly significant because, owing to the world reserve currency status of the dollar, the Federal Reserve has a huge impact on global trade, exchange rates, commodity prices, the value of dollar-denominated assets, investments, central bank holdings and much more, essentially being in control of global monetary policy.[5] Ultimately, the Federal Reserve sets the terms and conditions for global trade.

Quantitative easing is another feature of the central banking system. This is where central banks pump artificial money into the system by buying up government bonds and, as a result, the cost of money (and borrowing) is rendered abnormally cheap. In response to the 2008 global economic crisis, the Federal Reserve went on an unprecedented spree of quantitative easing, adding trillions of dollars in assets to its balance sheet with expansionary monetary policies: by the end of October 2014, the Fed’s asset sheet had grown to $4.5 trillion in bank debt, mortgage-backed securities, and treasury notes.[6] Ultimately, the Fed’s inflationary policies in this period amounted to an artificial stimulation of banks and markets by both the Federal Reserve and other G7 central banks.[7] During the 2008 crisis, quantitative easing by the Fed, along with the previously mentioned zero percent interest rate policy, led to a devaluation of the dollar, this resulted in cheaper exports for the U.S. and a reduction in imports for developing countries, who are left competing with artificially cheaper American goods whilst American manufacturers were effectively stealing developing countries’ share of exports as a result of the devalued dollar. The Joe Biden stimulus in 2020, a response to the economic impact of the COVID-19 outbreak, added $3.5 trillion to the money supply (equal to 20% of all the dollars ever created).

The result of these inflationary policies is clear. As the volume of money increases, the price of goods and services rise and the purchasing power of each unit of currency decreases, thereby reducing the value of our savings, assets, and pensions in the process. The supply of money and value of money are both tied together. Inflationary monetary policy by the Fed has led to the steady debasement of the dollar and this has caused asset prices to skyrocket as a result; especially non-fungible or non-liquid assets (that is, assets that cannot be returned, exchanged, or traded with ease or without losing value) like education, housing, and healthcare, that cost a fortune and can take a lifetime to repay back.

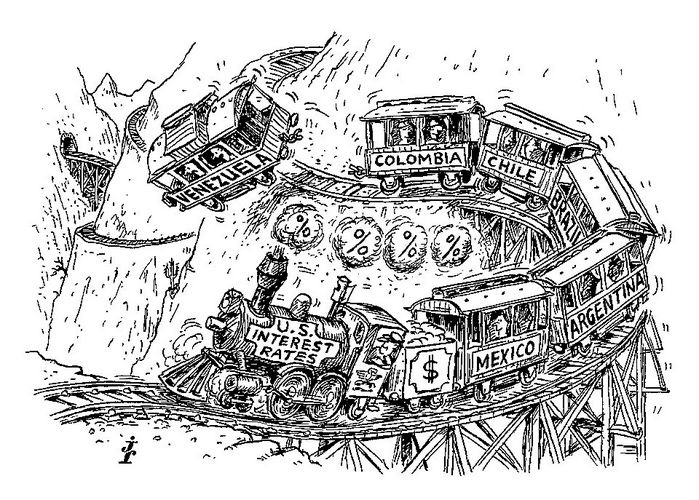

When the Federal Reserve raises interest rates the consequences can be devastating. In 1980, Paul Volcker, then the Chairman of the Federal Reserve, raised interest rates to 21 percent in a bid to end America’s long-term battle with inflation.[8] Known as the Volcker shock, this caused tremendous economic damage throughout the developing world especially in Latin America as interest repayments on outstanding loans soared as a result and the region experienced severe problems to do with hyperinflation, currency devaluation, capital flight, and debt. Economic chaos ensued and crime and poverty spiralled out of control leading to an exodus of people from Mexico and Central America north into the United States, a problem that continues to this day.[9]

Similarly, agricultural subsidies that the U.S. government gives to its farmers often means that international farmers simply cannot compete with the artificially low cost of U.S. products. This can happen when the Federal Reserve reduces the cost of borrowing and the domestic market is flooded with cheap credit. Likewise, when the Fed contracts the money supply by raising interest rates and making borrowing more expensive this can have a devastating effect across the global economy, often leading to a collapse in commodity prices. This gives the United States tremendous leverage in the global economy, which just isn’t an even playing field because international producers are always at the mercy of the Federal Reserve system.[10]

When interest rate hikes occur, this can lead to what is called a "price shock". This is when the price of a commodity drops by 10 percent or more causing chaos in commodity markets. As a result of the Volcker shock, commodity markets experienced over a 150 of these shocks between 1981 and 1987. Once again, commodity markets are held hostage by Federal Reserve monetary policy, pushing the exporting countries further into debt.[11]

Using artificial money, the Federal Reserve bails out the banks and keeps financial markets solvent. During the 2008 crisis, a new and controversial practice called dollar liquidity swap lines emerged, whereby the Fed extends lines of credit to the central banks of other developed nations to add liquidity to their markets. In return, these central banks are expected to be more accommodating to the Federal Reserve and to U.S. banks. This also strengthens the dollar’s position as the world reserve currency. Swap lines were used again during the COVID-19 recession in 2020.[12]

The Federal Reserve employs a number of financial practices and mechanisms that inflate the money supply, cause prices to rise, and debases the currency in the process.[13] [14] Foremost among these is the Cantillon effect, which allows the first receivers of the new money to buy up assets and invest this new capital before the onset of inflation begins in the economy and assets start appreciating.[15] This leads to a disproportionate rise in prices among different goods in the economy for different people, what has come to be known as “relative inflation”. Fractional reserve banking is another one of these practices, this sees banks lend many times the multiple of their actual reserves. Under a fractional reserve system, the big banks can lend out and earn interest on many times the multiple of their holdings and they do this with all the deposits they take in. Ultimately, the modern banking system is built on the practice of fractional reserve banking. Meanwhile, full oversight and control of market forces allows the Fed to pull their money out of the market before a downturn takes place. This is exactly what happened in 1929, cited by many to be a major contributing factor to the Great Depression of the 1930s. [16]

There is also the highly contentious issue that every bill that leaves the Federal Reserve has interest charged on it and thus the Fed has a built-in incentive to keep the monetary system going as such. Keeping interest rates low whenever possible allows for plenty of cheap credit, cheap credit leads to lots of borrowing which keeps us trapped within the system of debt and bondage indefinitely. It also increases inflation which, as mentioned previously, devalues our money making us all poorer in the long run and thus more dependent on credit to account for devalued money, and the debt, borrowing, and credit cycle begins once again.

The passing of Federal Reserve Act is what really formalised the power of the banks, providing the blueprint for central banking in the modern era. The act centralised control of the banking system, a system that preserves the interests of a cartel of bankers who dictate large segments of global trade by having absolute control over the means to exchange goods and services and to set value within the economy, as well as determining the level of supply and demand as well. No institution, no government, no corporation can rival the power of the Federal Reserve.

In stage two of this series, we will look at the 1944 Bretton Woods conference and how the dollar transitioned to the global reserve currency.

Notes

[1] Griffin, G.E. (2010) The Creature from Jekyll Island: A Second Look at the Federal Reserve. Amer Media. P.5

[2] Goodson, S.M. (2019) The History of Central Banking and the Enslavement of Mankind. Black House Publishing Ltd. p.73

[3] Rothbard, M. (2021) The Case Against the Fed. 2nd edn. Ludwig von Mises Institute. p.83-4

[4] Rothbard, M. (2021) The Case Against the Fed. 2nd edn. Ludwig von Mises Institute. p.70

[5] Prins, N. (2019) Collusion: How Central Bankers Rigged the World. Illustrated. Bold Type Books., p.88

[6] Wolfers, J. (2014) The Fed Has Not Stopped Trying to Stimulate the Economy. Available at: https://www.nytimes.com/2014/10/30/upshot/the-fed-has-not-stopped-trying-to-stimulate-the-economy.html?rref=upshot&abt=0002&abg=1.

[7] Prins, N. (2019) Collusion: How Central Bankers Rigged the World. Illustrated. Bold Type Books., p.56

[8] Klein, N. (2008) The Shock Doctrine: The Rise of Disaster Capitalism Picador. p.199

[9] Harvey, B. D. (2022). A Brief History of Neoliberalism by Harvey, David [Oxford University Press, USA,2007] [Paperback] (1st (First) edition). Oxford University Press, USA.

[10] Polaski, R.T.M.C., Samuel Amehou, Michel Petit, Sandra (2007) What Are the Impacts of U.S. Farm Policies on Developing Countries? Available at: https://carnegieendowment.org/2007/06/27/what-are-impacts-of-u.s.-farm-policies-on-developing-countries-event-1017.

[11] Klein, N. (2008) The Shock Doctrine: The Rise of Disaster Capitalism Picador. p.199

[12] Gros, D. and Capolonga, A. (2020) Global Currencies During a Crisis: Swap Line Use Reveals the Crucial Ones. Available at: https://www.europarl.europa.eu/cmsdata/207608/CEPS_FINAL%20online.pdf

[13] Rothbard, M. (2021) The Case Against the Fed. 2nd edn. Ludwig von Mises Institute. p.144

[14] Cantillon Effect | River Glossary (2021). Available at: https://river.com/learn/terms/c/cantillon-effect/.

[15] Rothbard, M. (2021) The Case Against the Fed. 2nd edn. Ludwig von Mises Institute. p.24-25

[16] Goodson, S.M. (2019) The History of Central Banking and the Enslavement of Mankind. Black House Publishing Ltd. p.103