Empire of Dollars

How the United States maintains control of the global monetary system - part 1: Introduction and overview

1. Introduction

The United States is the dominant superpower in the world today, a position it has held since the end of World War II. The United States’ gross domestic product (GDP) is the world’s largest, currently standing at $26 trillion annually compared with a world GDP of $105 trillion.[1] It has assembled the most formidable military in recorded human history with approximately 750 military bases around the world, meanwhile the U.S. is able to consume energy and resources on an unimaginable scale despite being only 4% of the world’s population.[2] All of this has led to trillions of dollars of debt and a huge trade deficit, in fact the United States’ national debt is actually higher than its GDP. These contradictions are all made possible by the U.S. dollar and its position within the monetary system, principally its status as the world reserve currency. The most fundamental component of the American empire is not its military, its commitment to freedom and liberty, neither its corporations or banks, but its currency, the dollar itself. This series attempts to explain the role and function of the U.S. dollar; why the dollar is the strongest currency in circulation and how it is the foundation of American power and the American empire. As a snapshot, consider that the U.S. dollar is used in 85% of all foreign exchange transactions worldwide, [3] over 59% of foreign currency reserves held in central banks are in dollars.[4] In fact, it is estimated that at least 90% of the world trade takes place in dollars.[5] The dollar is the currency of choice across a range of markets including for goods, services, assets and many more, and it is the benchmark pricing mechanism for commodities.[6] With a few notable exceptions, oil is traded in dollars only, meanwhile U.S. bonds and treasuries are widely regarded as the safest, most liquid financial assets available. The institution that is responsible for issuing the dollar, the Federal Reserve is, in my opinion, the single most powerful institution in the world today because as the primary issuer of the U.S. dollar it has absolute control to set value and to determine market conditions in the global economy. As I will go on to illustrate, it is no understatement to say that world trade, international finance, and the global economic system all revolve around the U.S. dollar.

In total, the United States of America has the most powerful commercial banks, the biggest economy, the most powerful central bank, the most liquid financial markets, the most in-demand and highest traded financial assets, the primary pricing mechanism for commodities and a virtual monopoly on the currency that oil is traded in as well. This is what I am referring to when I use the term “the dollar system”: various parts that form a self-reinforcing cycle of power and dominance. It is the most total and dominant financial system the world has ever seen. This is all owing to the position of the U.S. dollar as the world reserve currency and preserving this is critical to America’s ongoing status as the global superpower. America’s military, cultural, economic, political, corporate and banking dominance is pyramided on top of this system. By that I mean that America’s influence in these areas would naturally decline if the dollar lost its central position in the monetary system. Ultimately, without control of the monetary system the United States would not be as powerful and influential on the world stage as it is today.

The dollar system has survived numerous geopolitical realignments: the rise of China, the introduction of the euro, the two oil shocks of the 70s, global pandemics, the Great Inflation, war, terrorism, the 2008 global crisis and more. Over time, the dollar system has only gotten stronger.

Americans are taught that they are the global superpower and that their country is so successful because their people are dynamic and creative as well as hardworking and patriotic; these are some of the key aspects of what has come to be termed as ‘American exceptionalism’. Another popular line of discourse is that America is committed to freedom in a way that other nations simply are not. Additionally, the U.S. was founded on liberty and the liberty and freedom that its citizens enjoy parallels the free and open markets that it has purportedly built, both at home and overseas. “America is, well, just better at capitalism and freedom, sorry guys!” or so we are led to believe. Free markets and economic dynamism are not the reasons why the United States is the global superpower and neither is ‘American exceptionalism’. The United States has control of the global monetary system which confers numerous benefits and privileges on the U.S. that other countries do not have. Simply put, the reason why the United States is the uncontested hegemonic power in the world today is because the U.S. can print, borrow, issue and spend its own currency in international markets without having to worry about a ruinous devaluation of the dollar and suffering a total economic collapse, which other countries simply cannot do. This is because the very structure of the global monetary system means that no matter how many dollars are in circulation the global demand for the dollar ensures that there will always be buyers of dollars and dollar-denominated assets. Only the U.S. can do this because only the U.S. dollar functions as the world reserve currency and only Washington can issue the dollar freely.

Currently, there is a lot of talk in the international press about the role and the future of the dollar with many countries seeking to bypass the dollar system and use local currencies in trade and finance. Will China decouple from the dollar? What would happen if Saudi Arabia abandoned the petrodollar? Will the BRICS coalition bypass the dollar altogether? Vladimir Putin referenced the privileged role of the dollar in his now infamous “Empire of Lies” speech at Red Square, in Moscow, in late 2022. Meanwhile, in February 2023, the State Council of China launched a scathing attack on the United States and how Washington abuses the privileges that dollar hegemony grants them; being able to run up huge deficits and using the dollar system to “plunder the resources of other nations”.[7] Russia has the most nuclear weapons and tanks, China has the most active soldiers but America has the dollar.

Many who have challenged the dollar’s hegemony have met with a violent and brutal end, such as Muammar Gaddafi of Libya and Iraq’s Saddam Hussein: Gaddafi had designed a gold-backed, multilateral pan-African dinar (a direct afront to the dollar) and Hussein had switched oil transactions from dollars to euros, coinciding with a devaluation of the dollar, 18 months before the U.S. invasion (Iraq was the first OPEC country to violate the petrodollar arrangement since it began).[8] In 1975, Henry Kissinger stated that the U.S. was prepared to wage war over oil.[9] In 1980, President Jimmy Carter said that the U.S. would be prepared to repel any enemy in the Persian Gulf and to defend America’s interests in the region. The dollar is America’s primary export and the U.S. dollar is the heart of the American empire; this is why an attack on the dollar is an act of war in the eyes of Washington. That being said, the balance of power in the world is vastly different now than in the past and this presents numerous challenges and problems for the United States as it seeks to maintain control of the monetary system as we transition into a multipolar world order.

An Overview of the Dollar System

I have a three-part series that looks at the origins of the dollar system and the historical events led to its creation. For reasons of practicality, I will not go over them in too much detail here but for some perspective it is perhaps worth alluding to two events in particular. The first of these is the Bretton Woods conference in 1944, where the U.S. dollar was made the world reserve currency which meant that the dollar would be the principal medium of exchange in international trade and finance. The second occurred in 1971, when President Richard Nixon removed the dollar’s link to gold unilaterally, ending convertibility of overseas dollars into gold and thereby removing the last remaining constraints on money creation and any monetary obligations the United States had to the international community. Our money used to be tied to gold and, as such, governments and central banks couldn’t just run-up all the deficits they wanted but instead had to act with discipline and restraint, however that all changed in 1971 with Nixon’s landmark decision. Now, money creation is no longer constrained by any external obligations.

The dollar is unique because it is both a fully elastic, floating currency and one that, as the world reserve currency, is backed by near-infinite global demand as well. World reserve currency status means that the U.S. dollar is the chosen medium of exchange for goods, services, commodities, trade, travel, investments, central bank holdings and much more. The volume and frequency with which the dollar is traded means that it is the strongest, most liquid currency in circulation. Low interest rates and permanent demand for the dollar is what separates the U.S. dollar from other currencies. The structure of the monetary system means that demand for the dollar is permanently high and the interest rates the U.S. pays on its debts are almost permanently low as a result and this allows Washington to issue debt very cheaply (debt takes the form of what is called debt securities or debt instruments, namely government-backed treasuries and bonds) and the corresponding market for U.S. treasuries and bonds is arguably the most fundamental component to the dollar system after the world reserve currency status of the dollar. Even though the yield is low countries have no choice but to buy U.S. bonds and treasuries and invest in American debt. When countries enter the U.S. bond and treasury market to buy these assets they are, in effect, lending money to the United States and are subsidising U.S. debt and consumption in the process. What is important to understand is that there will always be buyers of U.S. debt instruments because demand for the dollar is built into the global economic system at virtually every level: countries need dollars in international markets (trade, investments, commodities etc) and for their reserves and to do this they must run a trade surplus indefinitely in order to acquire a sufficient amount of U.S. dollars. This holds true for every country except the United States, who can print the dollar at will, essentially by decree alone.[10] It is important to add that the interest the U.S. receives on its assets is several percentage points higher than the interest it pays on its liabilities. For most other countries, the reverse is true; they pay out more in interest on their liabilities than they receive on their assets (as it relates to the U.S. dollar). (N1) Contrary to free market fundamentals, when the dollar depreciates in value investors do not divest themselves of dollar holdings or dollar assets and seek out assets denominated in other currencies; instead, they increase their portfolio of dollars and dollar assets when the dollar is cheap, so assured are they that the U.S. dollar will recover.

The global monetary system is constructed in such a way as to absorb surplus dollars in perpetuity. China and Japan are the two countries who hold the largest amount of U.S. debt, traditionally the OPEC nations – particularly Saudi Arabia – have as well and this forms an integral part of the monetary system, allowing the U.S. to run up huge deficits and borrow indefinitely as a result. This is a crucial point to grasp because ultimately what this arrangement means is that the United States is allowed to borrow in perpetuity against this strong artificial demand; the necessity for other countries to stockpile both U.S. dollars and dollar-denominated assets is a permanent feature of this system. In order to get these dollar assets countries must lend U.S. dollars to the United States, the U.S. pays a small amount of interest to the creditor nation in return and this is essentially what allows Washington to accrue such large sums of debt. This system will continue as long as the U.S. dollar remains the world reserve currency.

As a result of its world reserve currency status, and the enhanced position in the global economy that this status brings with it, the U.S. dollar functions as a store of wealth, a measure of value and a medium of exchange in a way that few currencies do. There are many mechanisms in place that add liquidity and strength to the dollar. Trillions of U.S. dollars are traded daily on the foreign exchange markets and the majority of central bank holdings around the world are in dollars. The petrodollar agreement (in which oil is priced and traded in dollars only) consolidates demand for the U.S. dollar. The dollar has an important role in determining global commodity prices as it is the benchmark pricing mechanism for most commodities whilst the shadow banking system runs primarily on dollars and is estimated to be worth $52 trillion annually (several times that of actual goods and services).[11] This is why it is no exaggeration to say that the world runs on dollars because, to all intents and purposes, it does. The dollar system is a self-reinforcing cycle that ensures that the dollar is the most stable currency with the greatest purchasing power as well. Domestically, the U.S. can issue cheap credit with low interest rates attached. Lastly, when there is a global recession or economic downturn, investors buy dollar-denominated assets as these are seen as safe havens for capital, adding further liquidity to the dollar and raising its value. Many feel that the dollar is artificially overvalued as a result of its role in the global economy, giving the United States an unassailable advantage in global trade, finance, commerce and industry.

Ultimately, what this all adds up to is that this system gives Washington considerable leverage in international affairs and to pursue its broader geopolitical goals, whilst maintaining its current levels of debt, spending and consumption, without having to worry about the crippling effects of hyperinflation and a ruinous devaluation of its currency.

The dollar has frequently been referred to as a weapon in itself – literally “the dollar weapon” – because when the Federal Reserve raises interest rates this can spell disaster for developing countries with a significant amount of dollar denominated debt (such as what happened in the 1980 Latin American debt crisis) whilst in the geopolitical arena Washington can decide who receives dollar liquidity swap lines (basically, lines of cheap credit issued by the Federal Reserve) and, perhaps more importantly, who does not. Meanwhile, when investment from the United States dries up this can lead to similar macroeconomic problems for those countries (the 1997 Asian financial crisis is a good example of this). I will attend to all these topics and more during the course of this series.

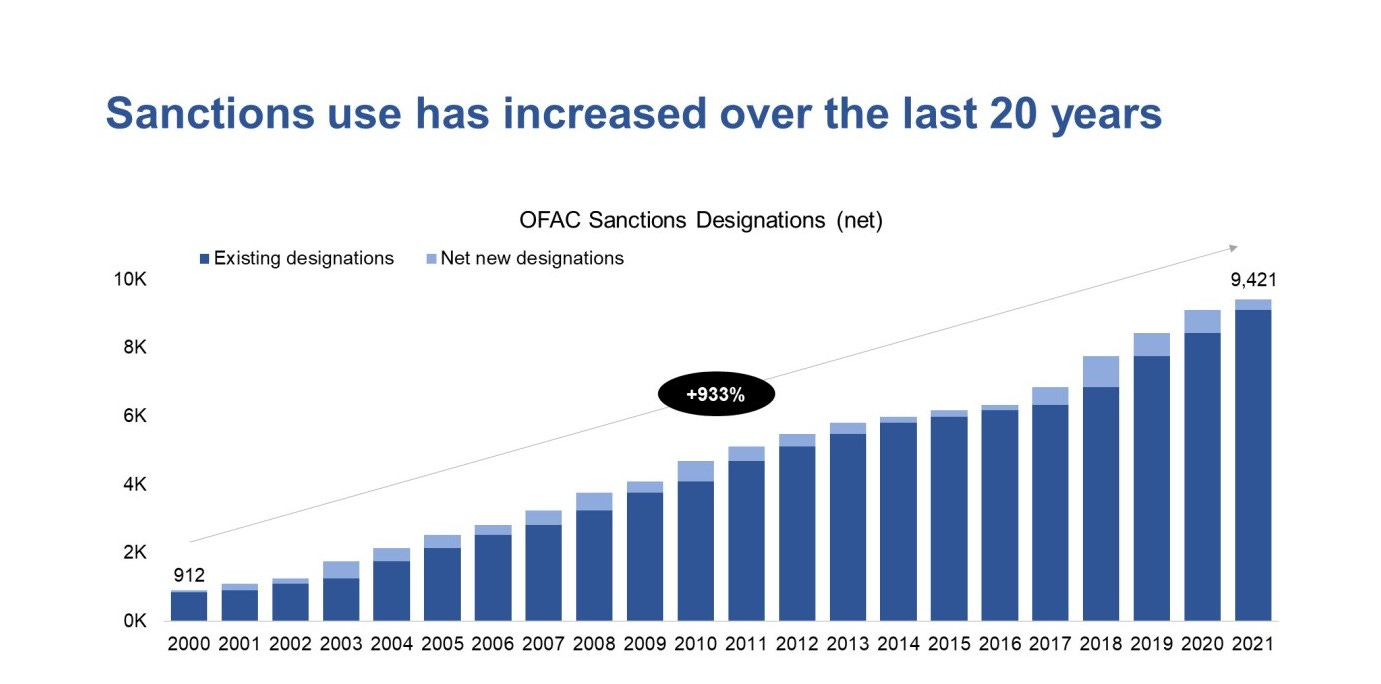

As one might expect, all of this has huge geopolitical implications as well. Countries that fall within the orbit of America’s imperium are afforded numerous benefits and privileges (such as the extension of dollar swap lines which is what happened during the 2008 global financial crisis) but nations that openly challenge the dollar system, and American hegemony more broadly, are cut off from vital organs of the global economy (Iran, Venezuela and Cuba are some notable examples) and are subject to ongoing embargos, boycotts, tariffs and more. In fact, since 2000, U.S. sanctions globally have increased by more than 900% according to some estimates.[12]

This system ultimately means that the United States is not forced to consume and spend less, produce more, be more competitive or run a more even trade deficit as other countries must. This is because the United States can print, borrow, and spend its own currency, the currency whose value only it can determine and that only it can issue freely, for use in international money markets to purchase all the goods, services, natural resources and raw materials it needs in pursuit of empire, to wage war and to assemble the formidable military required to pursue its geopolitical goals and primarily to defend this vast infrastructure. Other countries simply cannot do this, they have to operate with restraint and, as such, cannot compete with the United States on anything like an even playing field because of the strength, liquidity and stability of the U.S. dollar. If the U.S. lost control of the monetary system it would have to fundamentally alter its current tax, debt, trade and energy policies, all of which are severely imbalanced. The size and scale of the American empire would be vastly different as a result. In fact, it is no exaggeration to say that the entire balance of power in the world would be radically different without the dollar system.

Future instalments of this series will look at a whole range of topics including everything l have mentioned till now and much more: the petrodollar, interest rates, the role of China, the Federal Reserve, commodities, OPEC and exploring the idea of the dollar weapon. There is a lot to unpack, I am not sure how long this series will take (probably a while) but, alas, starting is half the battle and that much I have done.

Notes

[1] https://www.bea.gov/news/2023/gross-domestic-product-fourth-quarter-and-year-2022-advance-estimate#:~:text=Current%2Ddollar%20GDP%20increased%209.2,(tables%201%20and%203).

[2] Haddad, M. (2021) Infographic: US military presence around the world. Available at: https://www.aljazeera.com/news/2021/9/10/infographic-us-military-presence-around-the-world-interactive.

[3] https://www.bis.org/statistics/rpfx22_fx.htm

[4] https://data.imf.org/?sk=E6A5F467-C14B-4AA8-9F6D-5A09EC4E62A4

[5] https://thewire.in/world/dollars-yuan-gold-us-china-trade

[6] https://www.thebalancemoney.com/how-the-dollar-impacts-commodity-prices-809294

[7] https://www.fmprc.gov.cn/mfa_eng/wjbxw/202302/t20230220_11027664.html

[8] PDW, p.28

[9] PDW, p.45

[10] PDW, p.32

[11] Cox, J. (2019) Shadow banking is now a $52 trillion industry, posing a big risk to the financial system. Available at: https://www.cnbc.com/2019/04/11/shadow-banking-is-now-a-52-trillion-industry-and-posing-risks.html.

[12] https://home.treasury.gov/system/files/136/Treasury-2021-sanctions-review.pdf