Empire of Dollars 4

How the United States of America maintains control of the global monetary system - part 4: U.S. Treasury bonds

It is a mistake to think of the U.S. dollar as just one thing, as in just a unit of currency, because it is not. It is various nodes of financial and monetary power that all form part of a self-reinforcing system: the dollar system. Within the dollar matrix, Treasury bonds are a central component, providing a safe and reliable anchor for the dollar in the global economy. The bond market allows governments to borrow money by monetising their debts but for a variety of reasons, as I will explain in this article, the United States has more privileges and leverage in this area than other countries do. For the United States, over time, the trillions of dollars invested into U.S. Treasuries by Japan, China and the OPEC nations has served to both reinforce the American empire and strengthen the dollar system.[1]

The dollar’s position as the world reserve currency is anchored by U.S. Treasury bonds as the volume of trade in Treasuries maintains the high value of the dollar. U.S. Treasury bonds gradually replaced gold as the most in-demand reserve asset after the Bretton Woods system was abandoned in the 1970s. The world holds $7.6 trillion in Treasuries [2] and these U.S. government-backed Treasury bonds are a reliable store of value, considered to be the safest and most secure financial assets in the world, essentially risk-free investments that retain their value during normal and stressed market periods. Today, approximately $600 billion are traded daily in U.S. Treasury bonds.[3] The Federal Reserve and private U.S. investors have large portfolios of U.S. Treasuries as well. Many analysts believe it to be the single most important financial market of all as it allows the United States to consume far beyond its means (and correspondingly this consumption provides the foundations for large parts of the broader global economy).

The interest rates the U.S. pays on these Treasury bonds have historically been very low, partly owing to their unmatched reliability and safety as a financial asset and also because the world reserve currency position of the dollar maintains the high demand for these debt assets.

The advent of the petrodollar agreement in the mid-70s led to an expanded overseas market for U.S. Treasury securities. The terms of the petrodollar arrangement stated that a portion of the profits that OPEC nations made from their sales of oil would be reinvested into purchasing U.S. Treasuries essentially creating a parallel revenue stream for the U.S. with every barrel of oil sold. In 1974, the Treasury Secretary William Simon negotiated behind closed doors with Saudi Arabia to not only price oil exclusively in dollars but for the Saudi central bank to be able to purchase U.S. Treasuries outside of normal auctions.[4] Despite a period marked by turbulent economic times, between 1970 and 1980 the value of U.S. Treasuries increased seven-fold. From 1984 onwards, shortly after the end of the Great Inflation, the yield on U.S. Treasuries starts to decline rapidly giving the U.S. more leverage to borrow.

How the bond market works

In the simplest of terms, the bond market allows governments to borrow money. Governments typically issue bonds in order to raise capital to pay for their various obligations; whether to pay down debts or to meet any shortfall created from their budget commitments. When countries enter the bond market to buy the sovereign debt of another country, they are essentially loaning money to the debtor nation. In return, that nation pledges to pay back both the principal as well as the interest later (sometimes referred to as an ‘IOU’). This is called debt financing, whereby countries turn their own debt (a liability) into a financial instrument that becomes an asset in the hands of the creditor. In order to get these dollar assets, countries must lend U.S. dollars back to the United States in exchange for the physical bond that is traded in later for dollars. By buying U.S. Treasuries, investors not only have easy access to U.S. dollars but they also receive interest on their investment as well.

Benefits to the United States

However, because of the dollar’s world reserve currency position and the structure of the global monetary system, countries are constantly entering the U.S. bond market to purchase dollar-denominated assets such as Treasuries and other government bonds. Foreign central banks require large stores of U.S. Treasuries for their foreign exchange reserves and to protect themselves in the event of a run on their own currency. The dollar’s dominant position in the world economy means that countries stockpile large volumes of U.S. debt securities to be used later for an array of markets and obligations: the dollar is the currency of choice for goods, services, assets, investments, commodities, trade, travel and much more. The central position of the dollar in the global economy and the necessity for other countries to have an ample supply of dollars ad infinitum allows Washington to amass such large sums of debt and is one of the primary reasons why the world reserve currency position of the dollar is so important to America.

The monetary system we currently have is designed to absorb surplus dollars in perpetuity meaning that the U.S. economy will not collapse nor will the U.S. dollar suffer ruinous hyperinflation on account of all the dollars being printed and in circulation.

It has been pointed out by many that the large inflows of dollars from abroad through the sale of Treasuries to overseas investors allows the United States to set domestic interest rates very low and helps offset many of the structural imbalances of the U.S. economy. The U.S. is not forced to spend and consume less and can fund budget deficits simply by borrowing from overseas.[5] Other countries simply do not have these same privileges. This is all by design and as long as this system continues and the dollar remains the world reserve currency the United States can borrow indefinitely, running up huge deficits in the process. As I outlined in part two of this series, the spending that produces these enormous deficits is used to consolidate the global American empire; to fund war, to build military bases, to subsidise the military industrial complex and much more.

Interest rates

Washington can continue borrowing as long as interest rates are low but up until recently interest rates have remained very low, having steadily declined shortly after the end of the Great Inflation in 1982 (see below).

The lower the rate of interest the more the U.S. can borrow. The United States can set low interest rates on its debts because demand for the dollar is permanently high because other countries always need dollars (as outlined above). The dollar is like good fortune: you can never have enough of it. However, America’s fortune may be starting to run out as interest rates start to climb the cost of borrowing has increased and Washington is having to tread very carefully as a result.

U.S. Treasuries and the global economy

As with many other aspects of the monetary system, other countries simply do not have the same leverage and privileges in regards to debt financing as the U.S. does because their currencies are not back by the infinite demand of the U.S. dollar, demand that is the direct result of its world reserve currency status. There is only so much demand for the Mozambican metical, the Swedish krona or the Chilean peso so, correspondingly, these nations are limited in the extent to which they can monetise their debts. If foreign exchange markets have a surplus of the aforementioned currencies they will suffer a devaluation of their respective currencies which could lead to serious economic problems.

The structure of the global bond market enables the United States to spend and consume far beyond its means. But U.S. consumer demand and corresponding consumption is such an integral part of the global economic system many feel that large parts of the economy would collapse without the effective demand provided by the United States. So, for the global economy to function, essentially the U.S. must keep borrowing more and more money from the rest of the world and the international bond market for U.S. Treasuries helps facilitate this.

By the same token, for the U.S. economy to run the Federal government needs to keep borrowing and borrowing because its expenditures are so high. This is why the Federal debt of the United States is so large and its debt service repayments are high too. The U.S. must keep on borrowing just to stay afloat, meanwhile the debt and debt service payments grow and grow, it costs the U.S. $808 billion annually just to pay the interest on the existing debt, it is an altogether absurd situation.[6]

The market for U.S. Treasuries serves several purposes. Investing in the U.S. bond market means that countries can prevent their currencies from rising in value against the dollar; when this happens, it makes their exports more expensive for the American market as well as making their economies less desirable for U.S. investors. If countries converted their profits into their own currencies this could lead to domestic economic problems like inflation and asset bubbles forming. Another way of looking at this is that it indirectly prevents the dollar from devaluing; for countries that export heavily to the U.S. this is a situation best avoided because when that happens U.S. consumers and investors need more dollars for every euro, yen and yuan. As such, the bond market provides a safe haven for surplus capital that holds down the value of other currencies.

In the aftermath of the 1997-98 Asian crisis, Treasury purchases soared as many countries realised that having sufficient holdings of dollars was required to protect their currencies’ exchange rate from speculation, namely from the threat of future runs on their currency and maintaining exchange rates relative to the U.S. dollar.[7] During the 2008 global financial crisis, enormous sums were invested into the purchase of U.S. Treasuries, highlighting the extent to which overseas investors see them as safe, secure and reliable investments amidst an ensuing global crisis.[8]

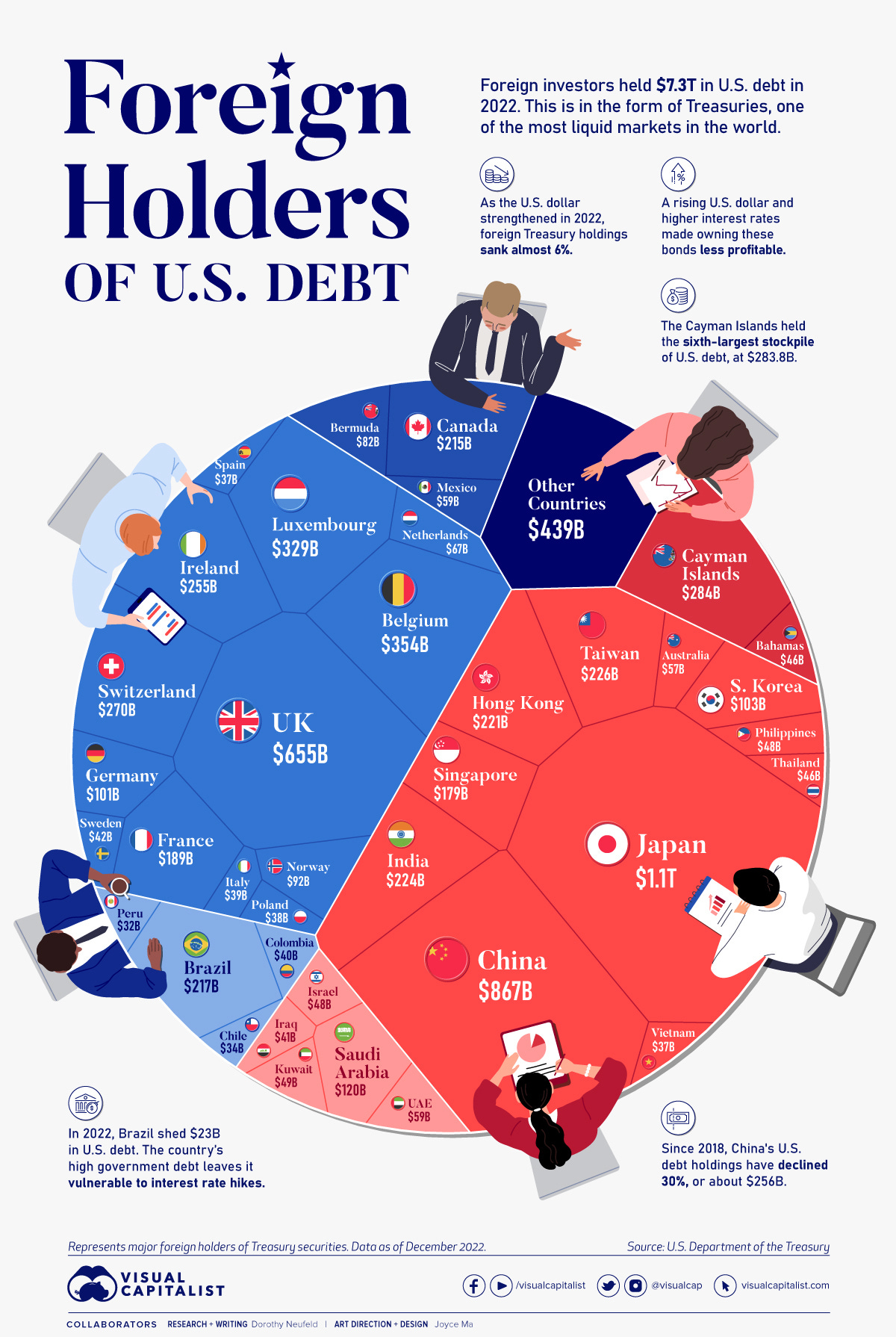

In the year 2000, just over $1 trillion in U.S. Treasury securities were held by foreign investors (government and private investors combined). By 2010, that had risen to approximately $3.5 trillion, now there is $7.6 trillion being held by foreigners.

The market for U.S. Treasuries is an integral part of the dollar system. It enables the U.S. to borrow and spend far beyond its means, without which the U.S. would have to reduce both its spending and consumption considerably. The huge volume of trade in U.S. Treasuries keeps the value of the dollar high and helps ensure that the dollar is the strongest and most liquid currency in circulation.

Notes

[1] Gindin, S. and Panitch, L. (2013) The Making Of Global Capitalism: The Political Economy Of American Empire. Verso Books., p.17

[2] De Mott, F. (2023) '$7.6 trillion of US government debt will mature in the next year, adding pressure on rates,' Markets Insider, 8 September. https://markets.businessinsider.com/news/bonds/us-debt-maturing-bond-yields-treasury-bills-federal-reserve-qt-2023-9.

[3] Major Foreign Holders of Treasury Securities (2023). https://ticdata.treasury.gov/resource-center/data-chart-center/tic/Documents/slt_table5.html.

[4] Spiro, D. (1999) The Hidden Hand of American Hegemony: Petrodollar Recycling and International Markets (Cornell Studies in Political Economy). 1st edn. Cornell University Press., p.x

[5] Spiro, D. (1999) The Hidden Hand of American Hegemony: Petrodollar Recycling and International Markets (Cornell Studies in Political Economy). 1st edn. Cornell University Press., p.46

[6] Fiscal data explains the national debt (no date b). https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/#:~:text=How%20much%20the%20government%20pays,over%20the%20past%20ten%20years.

[7] Gindin, S. and Panitch, L. (2013) The Making Of Global Capitalism: The Political Economy Of American Empire. Verso Books., p.286

[8] Gindin, S. and Panitch, L. (2013) The Making Of Global Capitalism: The Political Economy Of American Empire. Verso Books., P.302