Empire of Dollars 2

How the United States maintains control of the global monetary system - part 2: An overview of the benefits of the dollar system to the United States

2. An overview of the benefits of the dollar system to the United States

Debt, Consumption and Sustainability

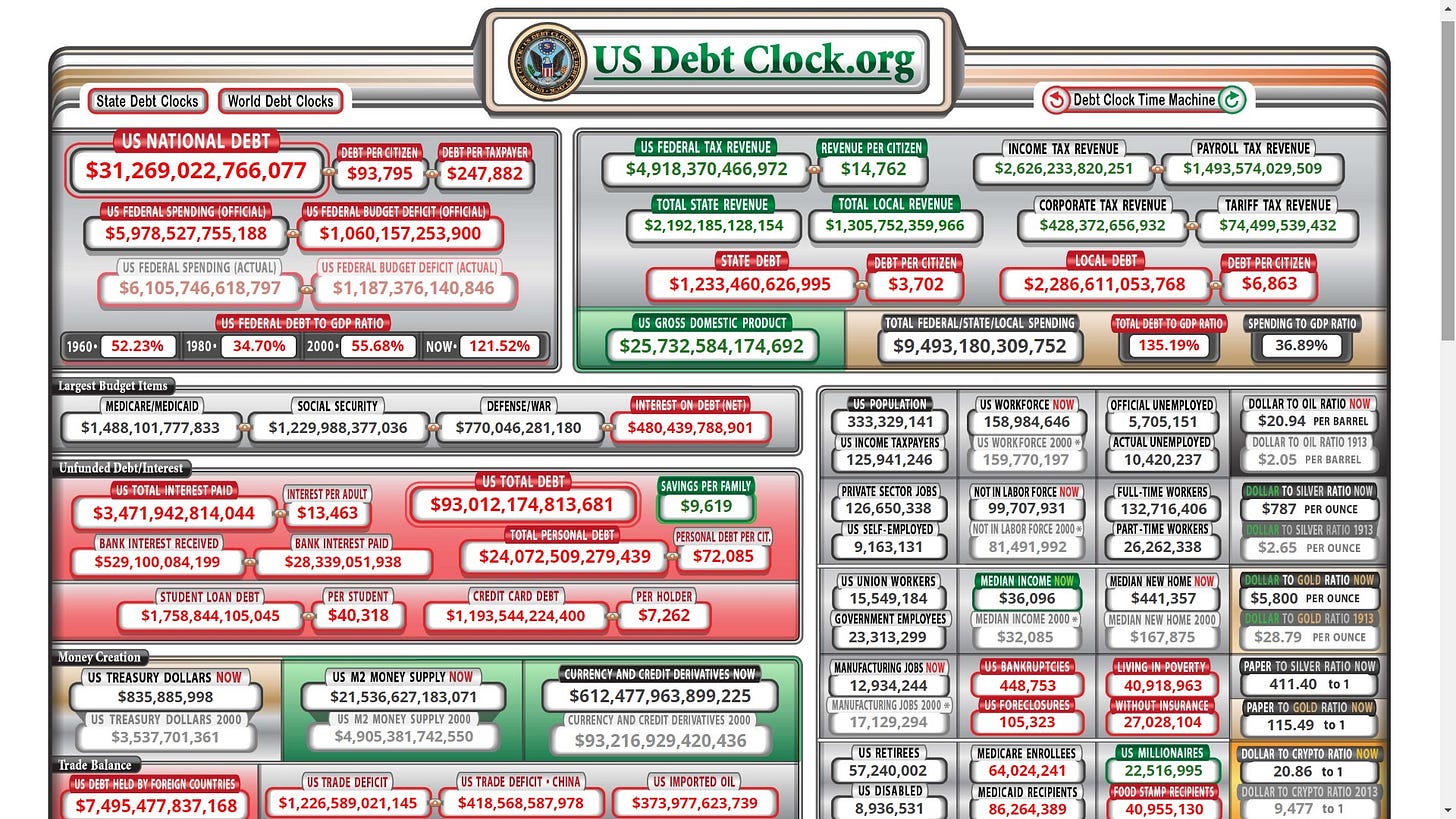

Currently, the U.S. runs enormous deficits and its national debt continues to soar: its total national debt is over $31 trillion, its debt to GDP ratio stands at an eye-watering 124%, while its trade deficit for 2021 was $859 billion, but these structural imbalances are sustainable if the dollar system continues and the U.S. dollar remains the world reserve currency position.

In modern times, debt takes many different forms. The true nature of the United States’ total debt is very much misunderstood by the public and misrepresented by the media and the so-called experts. The $31 trillion figure I provided above is the national debt of the United States, but this omits a whole host of other debt obligations. Future obligations such as unfunded liabilities (in relation to Medicare and Social Security) and pensions add up to tens of trillions more and when you include personal, student, state and municipal debt the United States’ total debt is anything north of $95 trillion. It also is worth pointing out that China and Russia, America’s main geopolitical rivals, have far less debt relative to the United States, hardly even a fraction: as a percentage of debt-to-GDP Washington’s is about 96%, Moscow’s is 17% and Beijing’s is just 14%.

Underpinning debt is consumption. The United States, relative to its population, consumes energy and natural resources on an almost unprecedented level. There are three reasons that underpin this level of consumption: 1) the U.S. has a population of 325 million people virtually all of which have a first world standard living (something that is unprecedented in the modern era), 2) following on from this is the fact that American culture and the American way of life is, to a large degree, predicated on high levels of consumption (in no small part owing to both its population and size [as in land mass]), 3) its overseas empire. The U.S. accounts for 20.3% of the world’s oil consumption, 21.7% of natural gas usage and 8.5% of coal consumption despite only being around 4% of the world’s population.[1] It is only fair and reasonable to point out that China rivals the U.S. for energy consumption but, relatively speaking, this has only really been the case in modern times whereas the United States has for decades consumed energy on an unparalleled scale. It should also be pointed out that China has almost five times America’s population and that seeing as it is the world’s central hub for manufacturing this is, to a certain degree anyway, to be expected.

Empire Building and Military

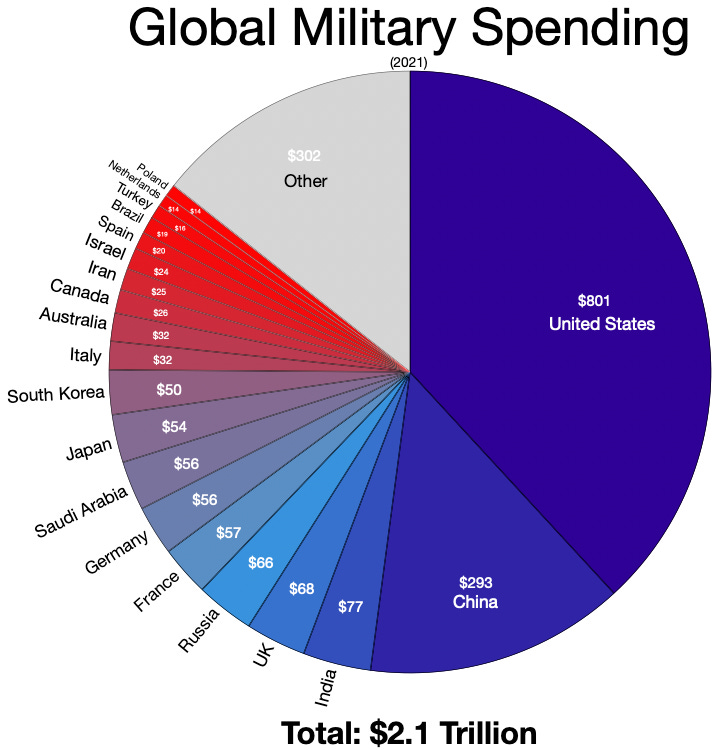

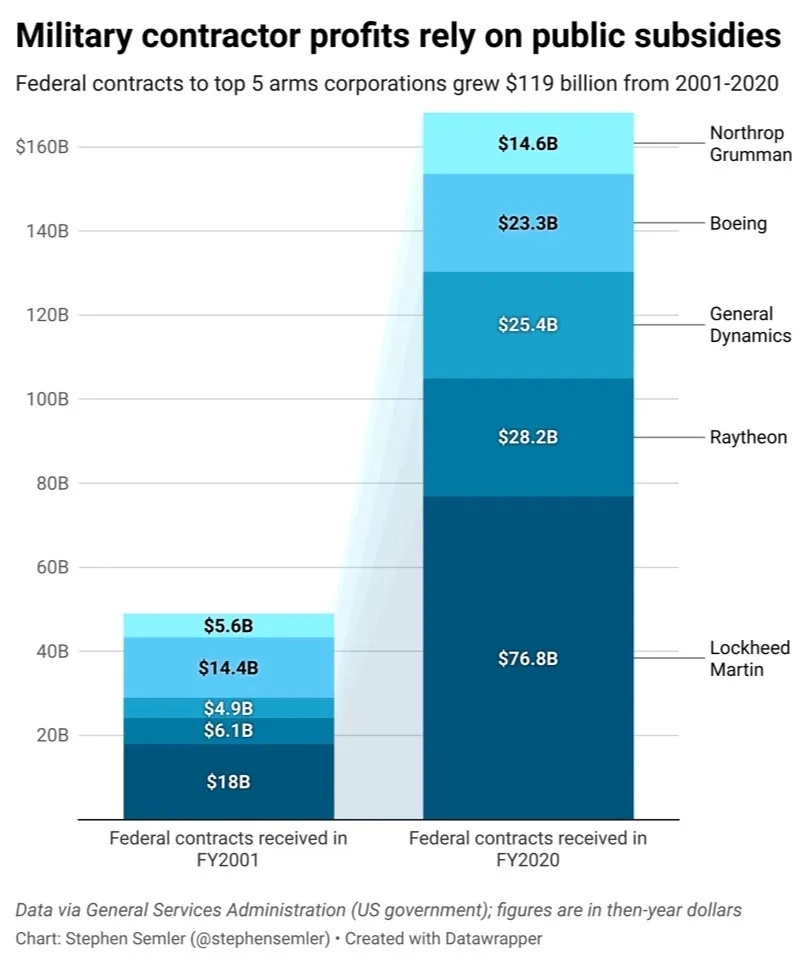

In terms of military expenditures, the United States spent over $800 billion in 2021 (source: macrotrends.net). Its military consists of 1,388,000 active personnel. Though estimates vary, the United States has approximately 750 military installations in over 80 countries around the world, it has a nuclear arsenal consisting of 6,450 warheads and it can grant billions of dollars in subsidies to corporations such as Boeing, Raytheon, and Lockheed Martin for military contracts.[2] The U.S. has 173,000 troops deployed around the world, ultimately what this all adds up to is that the United States plays host to the strongest military in history.

According to Wikipedia, in 2021 the United States spent more on its military than the next 11 countries combined (though this gap has traditionally been bigger) with the U.S. accounting for 38% of all military spending worldwide.

The dollar system allows the U.S. to pursue grand military projects, subsidising what has come to be termed as the military industrial complex; the likes of Lockheed Martin, Raytheon Technologies, GE, and other leading defence contractors, with the U.S. government providing them with billions of dollars of subsidies, sums of money that would be unthinkable without the dollar system we have today.

In Petrodollar Warfare, the author William R. Clark points out that if the United States were to lose the reserve currency status of the dollar, then its military strength will naturally diminish as a result.[3] The broader dollar system is the foundation upon which America’s military supremacy is built on and it is my firm belief that Washington would not be able to project power on the world stage without it.

As things currently stand, the composition and capability of the American military defies any meaningful comparison but, as a frame of reference, consider Washington’s naval fleet for a moment: In-spite of how powerful the Nimitz-class of aircraft carriers is, Washington will replace this with a superior fleet of Ford-class carriers in the not-too-distant future. A lot of American military hardware is just too expensive to export, other countries simply cannot afford it without either generous subsidies from Washington or wholesale modifications to the design.

For comparison, Britain, France and Russia have 30 overseas bases combined. China, America’s main geopolitical rival, has hardly any overseas military bases to speak of, and although it exerts considerable influence over a great number of countries using its now infamous policy of ‘cheque diplomacy’ this pales into insignificance when compared with America’s overseas military presence.

Another critical part of the U.S. empire is that the United States can grant billions of dollars in aid, loans and subsidies across the world primarily to bring about circumstances that are more in line with Washington’s aims and ambitions. Sometimes referred to as ‘soft power’ or ‘dollar diplomacy’, this is far more preferable and cost-effective than a full-scale military invasion. Washington does this either directly or through its proxies like the IMF and World Bank.

War

Much can be said about the dollar and its relationship to war. What cannot be denied is that the dollar system greatly enhances the United States’ capacity to wage war. A report commission by Brown University estimates that between 2001 and 2022 the United States spent over $8 trillion on its post-9/11 military engagements.[4] Decades prior, the Vietnam War is estimated to have cost $168 billion (equivalent to $844 billion in 2019 dollars and $1.47 trillion in 2021 dollars). This is largely enabled by having a floating, fiat currency that has no solid, metallic base to it; if we had a gold-backed currency that needed to be maintained by governments and central banks alike then the huge expansion of the monetary supply required to wage these wars and construct the vast military apparatus required to sustain the American empire would simply not be possible. Many feel that the dollar was taken off the gold standard in order to enhance the United States’ war-making capacity, a direct response to the rising cost of the Vietnam War.[5]

What also makes these military engagements possible is that the dollar system allows the United States to monetise its debts abroad to a level that no other country can do because demand for the dollar and for U.S. treasuries and bonds is permanently high. The renowned economist Michael Hudson has repeatedly made reference to this in his work, he says that the structure of the monetary system means that, in effect, other countries pay for America’s wars.[6] What Hudson is referring to is that the structure of the monetary system means that demand for the dollar is built into the monetary system, permanently, and this demand absorbs all the surplus dollars on foreign exchange markets shielding the United States from what would otherwise lead to tremendous economic problems to do with inflation, currency devaluation and eventually economic catastrophe. Part one of The Empire of Dollars explored this in more depth and future instalments of this series will unpack these ideas in greater detail.

Corporations and Banks

I will also add, briefly, that U.S. corporations and banks are also huge beneficiaries under this arrangement. Corporate America benefits as they are the recipients of low-interest loans and preferential treatment at the hands of U.S. banks, that gives U.S. companies an insurmountable advantage in global markets against rival companies from other countries that do not trade in the U.S. dollar but trade in other currencies. The major private U.S. banks, flooded with endless new inflows of dollars from the petrodollar trade and as a result of other countries investing in U.S. debt instruments, are full of fresh liquidity for loans, investment, and speculation in a range of financial markets. The self-reinforcing cycle of corporate, banking and political power has strengthened both the dollar and the American empire along with it.

Conclusion

If the dollar lost its status as the world reserve currency all the above – debt, empire, military, spending, consumption, war - would have to change and the United States would have to fundamentally alter its current tax, trade, debt and energy policies, all of which are severely unbalanced.

The structure of the global monetary system means that, as things currently stand, the dollar can be printed at will, at the behest of the United States government, the U.S. Treasury and the Federal Reserve, to acquire all the goods, services, raw materials and natural resources required to make the construction of the American empire possible. This has been the case since 1971 and it only stands to reason that Washington wants to keep things as they are.

These enormous benefits and privileges just would not be possible without either the world reserve currency position of the U.S. dollar, the floating, fiat status of the dollar and the vast monetary and financial infrastructure of the broader dollar system.

Notes

[1] World Energy Statistics - Worldometer (no date). Available at: https://www.worldometers.info/energy/.

[2] Haddad, M. (2021b) “Infographic: US military presence around the world,” Infographic News | Al Jazeera, 10 September. Available at:

[3] Clark, W. (2005) Petrodollar Warfare: Oil, Iraq and the Future of the Dollar. New Society Publishers. p.28

[4] U.S. Budgetary Costs of Post-9/11 Wars Through FY2022: $8 Trillion | Figures | Costs of War (2021). Available at: https://watson.brown.edu/costsofwar/figures/2021/BudgetaryCosts

[5] Graeber, D. (2012) Debt: The First 5,000 Years. New York, United States: Penguin Random House.

[6] Norton, B. (2022) “How USA makes countries pay for its wars: Economics of American imperialism with Michael Hudson,” Geopolitical Economy Report [Preprint]. Available at: https://geopoliticaleconomy.com/2020/04/24/us-war-economics-imperialism-michael-hudson/.

Thanks for reading Dissident’s Domain! Subscribe for free to receive new posts and support my work.