The Petrodollar: part two

The petrodollar wars - U.S. foreign policy and the dollar system

The first instalment of this series dealt with the origins and the mechanics of the petrodollar system and the benefits it brings to the United States. In this part, I will explore how U.S. foreign policy is not concerned with promoting freedom or democracy in the world but revolves around the necessity to defend the petrodollar at all costs and, by extension, the broader dollar system with it. Preserving the dollar system is essential to the United States’ continued role as the unchallenged, global hegemonic power in the world today. Put simply, this article is primarily about the application of brutal military force and unrelenting violence and terror applied by the United States military to maintain control of the petrodollar and the dollar system along with it.

The fundamental premise of my work on the dollar is that the global American empire is predicated on the dollar being the world reserve currency. The petrodollar is the central component of the dollar’s ongoing world reserve currency status: without this the U.S. would not be as dominant on the world stage as it is today. It follows from here that the status of the U.S. dollar must be protected no matter what. It is because of this that America will not accept an attack on the dollar; an attack on the dollar is an act of war in the eyes of Washington, regardless of who is in the White House. The dollar is the central component of the American empire and the lasting, enduring symbol of U.S. power. Any attempt to undermine this will be met with the full force of the United States military. The 2002 Afghanistan invasion, the 2003 Iraq War and 2011 invasion of Libya are all testament to this.

Readers should be aware that many of these concepts often overlap, so in order to avoid confusion some clarification is perhaps necessary: As the dollar system comprises of both the petrodollar and the world reserve currency status of the U.S. dollar these concepts are sometimes used interchangeably and much of what is written here applies to both the broader dollar system and the petrodollar too.

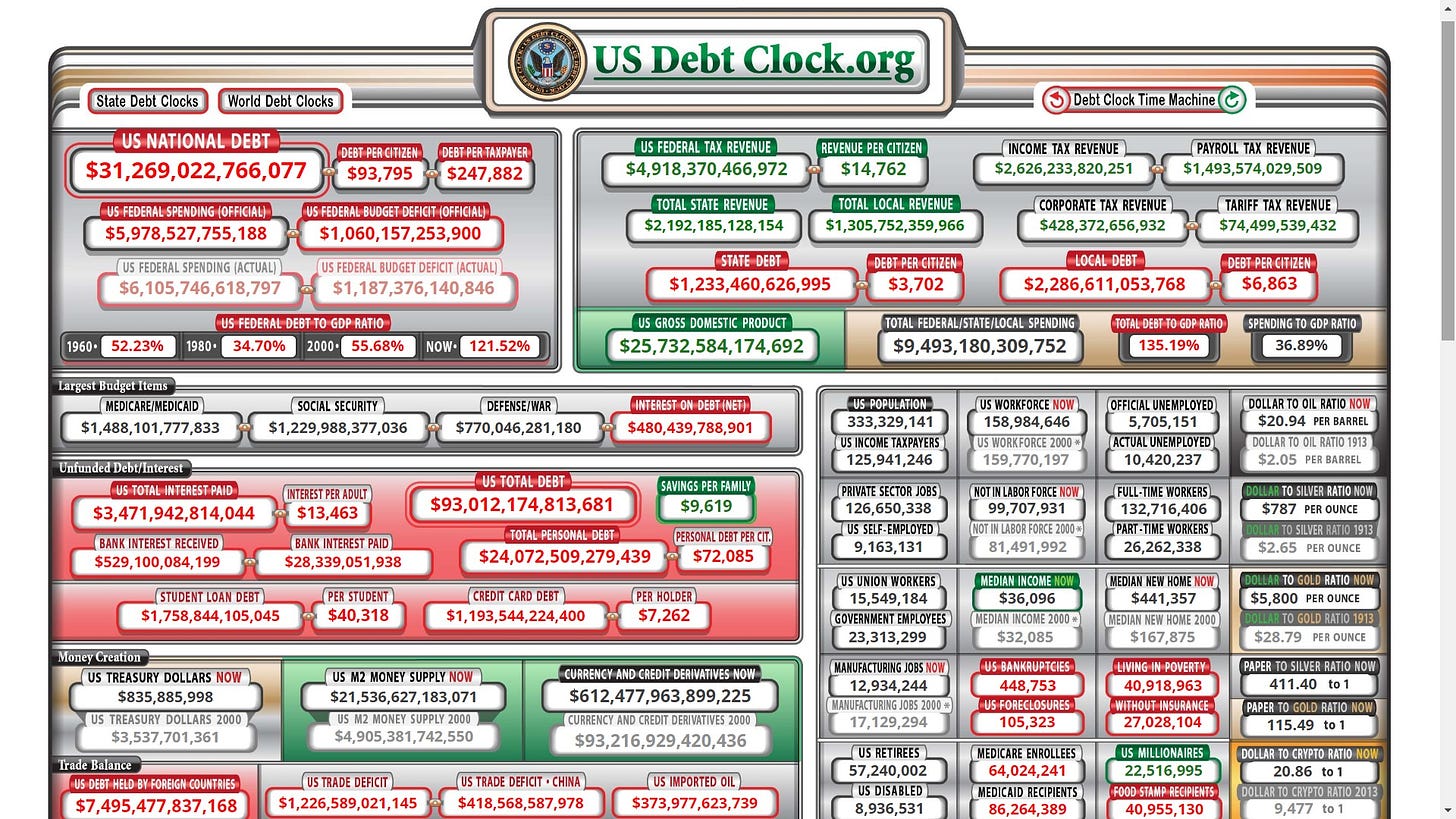

At the Bretton Woods conference in 1944, the dollar was made the global reserve currency, a position it still holds to this day. The American empire is intimately tied to the dollar’s status as the world reserve currency; this position, under a fiat system, allows Washington to both assemble a formidable military to pursue its geopolitical goals as well as allowing America to continue its current levels of debt, spending and consumption. World reserve currency status means that the U.S. dollar is the chosen medium of exchange for goods, services, commodities, trade, travel, investments and central bank holdings the world over. It means that it is the strongest, most liquid currency in circulation. Currently, the U.S. runs enormous deficits and its national debt continues to soar: its total national debt is over $31 trillion, its debt to GDP ratio stands at an eye-watering 124%, while its trade deficit for 2021 was $859 billion, but these structural imbalances are sustainable as long as the dollar remains the world reserve currency.

In the simplest of terms, when countries buy debt, they are essentially loaning money to the debtor nation and, because of the dollar’s world reserve currency position and the structure of the global monetary system, demand for the U.S. dollar is built into the current system. As a result, countries are constantly entering the U.S. treasury and bond market to purchase dollar-denominated debt instruments and other assets. This is all by design. In order to get these dollar assets countries must lend U.S. dollars back to the United States and this allows Washington to accrue such large sums of debt. As long as this system continues, the U.S. can borrow indefinitely, and this system revolves around the U.S. dollar’s position as the world reserve currency. For further clarity, I will now provide a more detailed description of how this system works.

The dollar system and the dollar’s position as the world reserve currency confers numerous advantages and privileges to the United States that other countries simply do not have. Ultimately, this system allows the United States to maintain all these deficits and spending because demand for the dollar is permanently high and the interest rates it pays on its debts are almost permanently low as a result. The steadily declining interest rate on a 10-year U.S. treasury bond is evidence of this as, over time, what came to be known as petrodollar recycling pushed down interest rates for the U.S. (see the graph below). Petrodollar recycling is the process by which OPEC nations take a portion of the profits from their oil sales and reinvest them into the market for U.S. debt securities, such as treasuries and bonds (that can be exchanged for dollars later), in perpetuity.

It also needs to be stated that a similar arrangement now takes place with other nations as well, especially China and Japan who hold the largest volume of U.S. debt instruments and other dollar-denominated assets.

This is all because the dollar-based system we have ensures that demand for the dollar is ever-present, it is built into the global economic system at virtually every level: countries need dollars in international markets (trade, investments, commodities etc) and for their reserves and to do this they must run a trade surplus indefinitely. It is estimated that around $6.6 trillion are traded on the foreign exchange markets daily, 59% of foreign central bank holdings are in U.S. dollars and the U.S. dollar is used in 85% of all foreign exchange transactions worldwide, whilst the petrodollar agreement (in which oil is priced and traded in dollars only) consolidates demand for the U.S. dollar. The dollar has an important role in determining global commodity prices as it is the benchmark pricing mechanism for most commodities whilst the shadow banking system runs primarily on dollars and is estimated to be worth $52 trillion (several times that of actual goods and services). This is why it is no exaggeration to say that the world runs on dollars because, to all intents and purposes, it does. The network effect of all this means that the volume and frequency with which the dollar is traded makes it the most liquid currency in circulation, it is a self-reinforcing cycle that ensures that the dollar is the most stable currency with the greatest purchasing power as well, meanwhile dollar-denominated assets, government-backed debt securities such as bonds and treasuries, are safe and reliable investments and, as such, the corresponding market for these assets is estimated to be the most liquid and reliable financial market in the world today. Domestically, the U.S. can issue cheap credit with low interest rates attached. Lastly, when there is a global recession or economic downturn, investors buy dollar-denominated assets as these are seen as safe havens for capital, adding further liquidity to the dollar. This gives Washington considerable leverage in international affairs and to pursue its broader geopolitical goals, whilst maintaining its current levels of debt, spending and consumption, without having to worry about the crippling effects of hyperinflation and a ruinous devaluation of its currency.

Ultimately, this means that the United States can spend its own currency, the currency whose value only it can determine and that only it can issue freely, for use in international money markets to purchase all the goods, services, commodities, natural resources and raw materials it needs to pursue its geopolitical aims and objectives, all because of the many structural advantages I have outlined above. Other countries must operate with restraint and, as such, cannot compete with the United States on anything like an even playing field because of the strength, liquidity and stability of the U.S. dollar. Under this arrangement, the United States is not forced to consume and spend less, produce more, be more competitive or run a more even trade deficit, as other countries have to. And this is all made possible by the fact that the dollar is the world reserve currency, a position it assumed at the Bretton Woods conference, a position it has not vacated since.

The effect of an OPEC switch to another currency would be disastrous for the United States. It is predicted by some that the dollar would lose anything up to 40 percent of its value. Were this to happen, demand for the dollar would collapse and countries would scramble to exchange dollars for whichever currency or currencies OPEC chooses to trade oil in, the market would be flooded with surplus dollars that would, in turn, overwhelm the global economy, the inflationary pressure on the dollar and the U.S. economy as a whole would be disastrous and the deficits that the U.S. currently runs would become unsustainable. Now this might sound far-fetched but when you consider the structural imbalances in the U.S. economy, the United States cannot afford to lose either the petrodollar or the world reserve currency status of the dollar, the consequences would be catastrophic.

The U.S. Military

The United States has assembled a military unrivalled in human history. Its strength, size and scope are simply unparalleled and defies any meaningful comparison, there really is no other way of describing it. But why is this exactly?! The chances of the U.S. being invaded are small to say the least as both the bordering Pacific and Atlantic Oceans act as natural fortifications against an attack. In fact, you can count on one hand the countries that have the naval capacity that could even entertain the idea of such an assault. The United States only has two land borders and these are with countries, Canada and Mexico, firmly within its geopolitical orbit. Any nation trying to attack the U.S. by means of invasion would be committing suicide and that is putting it lightly.

The U.S. has assembled this formidable military apparatus and infrastructure in order to protect the dollar’s role as the world reserve currency and with it its dominant position in the world today in what is essentially a high-stakes power play in the game of geopolitics. The U.S. military is both the product of the dollar system and its primary line of defence. The privileges and benefits that having the world’s reserve currency allows in regards to printing, borrowing and spending is particularly significant when we are talking about defence spending. It is also worth pointing out that this colossal spending on military (and eventually on war itself) was made possible by moving to a pure fiat standard, as the United States did in 1971 (which I cover in considerable detail in my articles on the Nixon shock). According to Wikipedia, in 2021 the United States spent more on its military than the next 11 countries combined (though this gap has traditionally been bigger) and the United States accounts for 38% of all military spending worldwide.

The dollar system allows the U.S. to pursue grand military projects, subsidising what has come to be termed as the military industrial complex; the likes of Lockheed Martin, Raytheon Technologies, GE and other leading defence contractors, with the U.S. government providing them with billions of dollars of subsidies (see below), sums of money that would be unthinkable without the dollar system we have today.

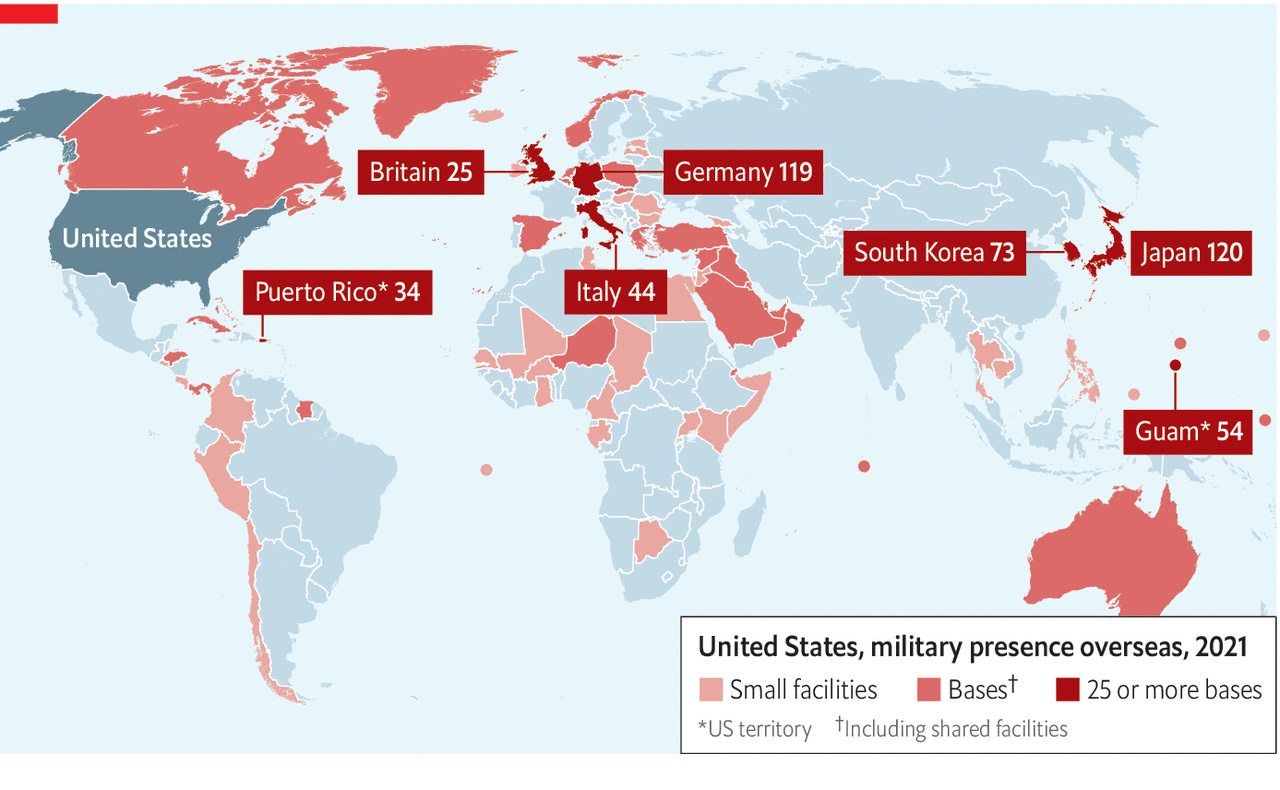

Given the current situation, the United States can project force from virtually anywhere on the globe, in theory it is able to engage in open conflict in many theatres at once, it has 750 military installations in over 80 countries across the world (see map below), Britain, France and Russia have 30 overseas bases combined. This is why the petrodollar must be defended no matter the cost. As I will cover later on, the U.S. military has been used to devastating effect in Iraq and then Libya in order to protect the status of the dollar and, with it, the American empire as well.

In the grand chessboard of geopolitics, it is important to recognise that the presence of the U.S. military in the Gulf region is a double-edged sword for these countries. Hypothetically speaking, the U.S. military apparatus that was installed to provide protection to Saudi Arabia and the other OPEC states in the region could also be used to launch an offensive against these client states should they no longer be compliant. Another important point to consider is that the U.S. must contain the threat of anything that may prove hostile to American interests: this could be in the form of a revolution that destabilises the region or a political party that doesn’t comply with Washington or even if the existing status quo in the Middle East has a change of policy. The Middle East is arguably the most complex geopolitical arena in the world today and unpacking it fully is honestly beyond the scope of this article. The Arab Spring and the ongoing Syrian Civil War demonstrate how volatile the region is. Israel is the source of a lot of tension in the Middle East and has been for over 75 years, as are very complex and nuanced demographics across the region. Along with two of the world’s most critical choke points for trade, the Suez Canal and the Straits of Hormuz, complicating this is religion and the split between Sunni and Shia Islam, to say nothing of ISIS, al-Qaeda and the Taliban that all patrol the region. The point is that, however you choose to look at the Middle East, there are many things that could potentially destabilise the petrodollar and America’s interests in the region. The United States’ large military presence in the Middle East is there to preserve the petrodollar and the protect the dollar system from this instability. It isn’t there to spread freedom and democracy or to safeguard minority rights as the mainstream media would have us believe; it is there to repel any potential threat to the U.S. dollar. The region is on a perpetual knife edge and this necessitates America’s ongoing presence there should anything arise that tips the balance of power against Washington’s interests, especially anything that would threaten the petrodollar.

It should also be acknowledged that protecting vital trading routes is another role that America's vast military infrastructure fulfils. The Indian and Pacific Oceans are littered with various important choke points for international trade, such as those contained in the Persian Gulf, the South China Sea and the Red Sea. The dollar system is intimately bound up with world trade, so much of world trade revolves around the dollar that guaranteeing safe passage for vessels transporting oil and other vital commodities, as well as commercial cargo, is essential for maintaining the arteries of world trade and the dollar system with it. Any significant disruption of these trading routes could have potentially disastrous effects on the value of dollar. The dollar would probably recover, yes, with the effects being short-term but it could still be problematic nonetheless.

Ultimately there is no real exit plan for America; for as long as the United States is the dominant superpower it will always need a strong military presence in Middle East as the petrodollar is an essential component of the U.S. empire and needs to be preserved as such. This is an existential problem that cannot be easily resolved: the longer the U.S. stays in the Middle East and involves itself in the affairs of foreign nations the greater the resentment against America grows which leads to greater instability in the region as a whole. But if the U.S. vacates the Middle East, then what? Who will fill the power vacuum left by the United States? What would become of the petrodollar? And would the dollar’s position as the world’s reserve currency endure? These are all deep, searching questions, ones that cannot be answered easily or resolved in a peaceful manner either. Stay or leave, both scenarios are fret with danger and unpredictability.

Iraq

The Iraq War lasted over eight years, cost $2 trillion, and claimed the lives of approximately 110,000 Iraqi civilians, 4,500 American personnel and 34,000 Iraqi personnel. It should be noted that the civilian death toll is the subject of much dispute, easily reaching over the half a million mark if you include insurgencies and the subsequent ISIS occupation.

The reasons provided for the invasion were tenuous from the start. The U.S. made spurious claims that Iraq had weapons of mass destruction that were never found despite numerous UN inspections (approximately 400 in total), were this threat credible then there would have been greater international backing behind the invasion. And despite rhetoric to the contrary from Washington, there was no credible link between al-Qaeda and Saddam Hussein. Saddam never attacked the U.S. or harmed American citizens either. Alan Greenspan, the chairman of the Federal Reserve at the time, admitted that the invasion was about oil. Senior policy advisor to the Bush administration, Richard Perle, confessed that although the war was a violation of international law it was nevertheless the “right thing” to do.

The actual reason why the United States invaded Iraq has been missed by many: the United States invaded Iraq in order to switch oil transactions back into dollars and, in doing so, defend the petrodollar and reaffirm the dollar’s position as the world reserve currency. What is also highly significant is that at the time Iraq had the world’s second largest proven oil reserves as well, as such its position in the global oil economy was second only to Saudi Arabia so Baghdad abandoning the dollar standard for the euro could potentially have led to disaster for the United States. Let’s unpack this a bit more. Prior to the U.S. invasion of Iraq, Saddam Hussein had discarded the dollar and began trading oil in euros continuously for three years straight. By February 2003, he had sold 3.3 billion barrels of oil for 26 billion euros. But by discarding the dollar and adopting the euro, Saddam made a huge profit as the euro gained about 17% against the dollar during that time. He also switched the fund for his ‘oil for food’ programme from dollars to euros, opening an account with the French bank BNP Paribas. However, one highly significant point that often gets omitted, and it is a fairly nuanced point at that, is that at the time of the switch, Saddam and Iraq stood to lose by switching to the euro (Saddam was, obviously, fully aware of this but wanted rid of the dollar nevertheless as he felt that Iraq was not being adequately compensated for his country’s oil and that America was profiting at Baghdad’s expense). The euro went on to gain on the dollar after the switch with many analysts arguing that Saddam’s switch was itself the reason for the dollar’s devaluation and thus further impetus for the American invasion as this decision by the Iraqi Ba’athist leader represented a direct attack on the petrodollar and, by extension, an attack on the American empire. Dedollarising meant increased profits for Saddam and more autonomy in the global oil economy. But by moving oil sales off the dollar and on to another currency, it reduces the demand for the U.S. dollar and reduces its liquidity in doing so, in effect reversing the monetary cycle that has been the foundation for U.S. power for decades. This liquidity was then effectively passed on to the euro. Having observed Iraq make a profit by switching from dollars to euros, this could have created a domino effect whereby one OPEC country after another removed the dollar peg, such momentum away from the U.S. dollar as the currency for oil transactions could have had catastrophic consequences for the United States. It is also important to state that from its inception in the mid-70s till 2000, no OPEC member state had violated the terms of the petrodollar agreement. Ultimately, dumping the dollar and moving to another currency was a direct attack against the dollar and this could not be allowed to stand.

America’s decision to launch a full-scale war against Iraq was effectively a policy of containment. This war was waged in order to protect the petrodollar and regain strategic control over Iraq’s vast oil reserves. Invading Iraq sent a message to other OPEC member state that if they fall out of line, the U.S. will act decisively to restore the geopolitical order that best serves its own interests. In Petrodollar Warfare William R. Clark advances a similar theory, he writes:

“Petrodollar warfare was ushered in on March 19th 2003, with the unprovoked military invasion of Iraq by the US, UK and a small contingent of Australian soldiers. Bluntly stated, petrodollar warfare unfortunately represents the application of violence by the US intelligence agencies or military to enforce the dollar standard as the monopoly currency for international oil transactions.”

Clark claims that the Iraq War was an “oil currency war”, essentially waged to maintain the dollar’s position as the global reserve currency and to prevent further momentum to the other currency that was coming to prominence at the time: the euro. After its advent in 1999, the euro was in the ascendency and many countries were transferring their dollar holdings into euro-denominated ones. The dollar was extremely volatile around this time, facing one crisis after another. The EU had a much better balance of payments than the U.S., with Washington running huge deficits on its end, meanwhile the EU had a small but positive net trade surplus. The former German Chancellor Helmut Schmidt said in 1997:

“Americans do not yet understand the significance of the euro, but when they do it could set up a monumental conflict, it will change the whole world situation so that the United States can no longer call all the shots.”

Round about the time that the euro was introduced the dollar was subject to a lot of instability in global markets: there was the dot-com crash, the Enron scandal, recessions in the U.S. and the 9/11 terror attacks. The euro was gaining during all of this, as French and German representatives were proposing to major holders of U.S. assets (namely China, Japan and Russia) to switch their dollar holdings into euro ones (though eventually the euro would have to devalue as its strength was undermining German exports). Clark notes that as the Iraq War was being debated in the UN, China and Russia began unloading dollars and buying euros, this led to the dollar devaluing right before the war commenced, China and Russia took these actions most likely in anticipation that the invasion of Iraq would itself lead to a devaluation of the dollar. Ultimately, Washington knew that all this momentum away from the dollar would spell disaster for the United States were it allowed to continue unchecked.

Competition for the exploration of untapped oil supplies in Iraq were also a key factor in the invasion. Iraq had signed contracts with leading French (TotalFinaELF), Russian (Luk Oil), Italian (ENI) and Chinese (Sin-oil) oil companies to begin exploration for oil and to redevelop its deteriorating oil infrastructure (which had declined considerably under UN sanctions). This would have meant more oil transactions being denominated in euros and more influence and autonomy in Iraq’s oil trade by other nations which undercuts U.S. hegemony in the region as well as strengthening Saddam’s hand in the process. This could not be allowed to stand and so the U.S. cancelled all these contracts immediately.

Libya

The 2011 NATO-led invasion of Libya lasted just over seven months and saw Muammar Gaddafi removed from power in brutal fashion. Casualty estimates vary but one source, the African Journal of Emergency Medicine, says that over 21,000 people died during the conflict and over 400,000 people were displaced. The event received very little attention in the mainstream media, very little, indeed there is an eerie, blanket silence behind the Libya invasion and researching it for the purpose of this article was challenging to say the least. Donald Trump once exclaimed that “nobody even knows Libya”, he was right.

A CBS News clip of Hillary Clinton’s disturbing proclamation about Colonel Gaddafi, “We came, we saw, he died”, referenced his brutal death on a major national news network. The reasons provided for the intervention were more specious than those given for the Iraq invasion. An independent parliamentary investigation in the UK concluded that the “strategy was founded on erroneous assumptions and an incomplete understanding of the evidence”. One of the few reasons offered up was that Gaddafi had targeted civilians but there was hardly any credible evidence of civilian massacres at all, the British investigation referenced above claims that these reports were drummed up propaganda campaigns by Western governments. Indeed, Gaddafi was planning to work with the rebels in Benghazi, starting with giving them an offer of peaceful surrender and government assistance with their various grievances.

So the logical question is, what was this invasion all about then? At a meeting of the African Union in 2009, Gaddafi suggested to other African nations the idea of switching to a new currency, independent of the American dollar: the gold dinar. The objective of this new currency was to divert oil revenues towards state-controlled African banks rather than western and American banks. In other words, to stop using the dollar for oil transactions. Countries such as Nigeria, Tunisia, Egypt and Angola were ready to change their currencies but the 2011 invasion of Libya stopped that from happening.

With an excellent management of oil revenues, the Libyan state had managed to store a substantial amount of gold, 143 tons according to WikiLeaks, valued at $7 billion, and the same amount in silver (a relatively large amount of gold and silver for a country with a population of 6.2 million people). This was a sound monetary system with a metallic base that would be used as collateral for the newly introduced, pan-African gold dinar to trade oil in. The new currency would be split between gold dinars and silver dirhams. It is also worth noting that Libya had the highest amount of oil reserves in Africa and that Gaddafi also had ambitions of pioneering an African Central Bank too. Gaddafi wanted to extend this system to most of the African continent, finally releasing it from its historical bondage to western powers.

Gaddafi wanted to create an axis between Libya’s oil, the gold and silver reserves he had amassed, the new gold dinar currency and a new stabilising monetary union, the African Central Bank. Eventually other countries would join helping to consolidate and grow the system. He wanted to unite all the African countries under one unified dinar, then move oil transactions off dollars and on to this new currency, undermining the petrodollar trade in the process. Alex Newman, from The New American claimed:

“But if Arab and African nations had begun adopting a gold-backed currency, it would have had major repercussions for debt-laden Western governments. And it would have spelled big trouble for the elite who benefit from “freshly counterfeited funny-money” (central bank-controlled fiat currency).”

Other major African governments were ready to support the gold dinar project going forward. Removing African countries off the dollar and having them trade in their own unified currency would have been a catastrophe for the U.S. dollar and its role as the world’s reserve currency. As previously mentioned, in 1999 the euro was introduced and provided direct competition to the dollar in global markets. The introduction and circulation of another competing, multilateral currency would have a similar network effect. Russia Today called the plan "an idea that would shift the economic balance of the world". It is important to state that what Africa lacks in per capita spending power it more than makes up for in raw materials, commodities and natural resources. Like oil, many raw materials and commodities are traded in dollars only, gold (ironically) and coffee among them; once again, moving all this trade off the dollar would have spelt disaster for the United States.

North Africa is the bridge between the African continent and the Middle East and many have speculated that Colonel Gaddafi had grand plans to eventually unite all the oil trading nations from the Middle East, North Africa and Sub-Saharan Africa together, effectively ending the petrodollar and an American-dominated OPEC along with it. The author tries to avoid unfounded generalisations but I sincerely believe that doing so would have meant the end of the American empire as we know it.

Both the Iraq War and the Libyan invasion were sold to the people in the west as acts of philanthropy and liberation. Americans think these are just wars because the media tells them they are fighting the bad guys, it just isn’t that simple: I would implore everyone to look past the mainstream media narrative behind the forever wars and understand them for what they really are: military interventions done to protect the petrodollar and the dollar system. A famous New York real estate magnate and business mogul once proclaimed on CNN in 2015 that the world was safer with Gaddafi and Hussein in power. That individual was no less than Donald J. Trump, three years before he would become the 45th president of the United States. The interview was before the full consequences of Hussein and Gaddafi’s violent removal would be fully realised, consequences I will return to later in part three of the petrodollar series.