The Nixon Shock: part two

How the Nixon shock changed the world forever

Globalisation of Fiat System

The creation of the fiat dollar changed the world forever because the reality is that as the dollar became a floating fiat currency so, by necessity, did all the other currencies in the world. This is because the articles of the Bretton Woods agreement meant that every other currency was pegged to the dollar so when the U.S. dollar became fiat all the other currencies had to as well in order to keep pace with the dollar. For the first time in history, the world was in a pure fiat standard. The dollars held by central banks across the globe lost their backing, and so had every other currency of significance: from the yen to the mark, from the pound sterling to the franc. Now all governments are beholden to this system and every government in the developed world does practically the same thing, especially in regards to monetary inflation, deficit spending, and accruing large, unrepayable debt (although, it is important to add, not to the same extent that the U.S. does). According to the Institute of International Finance (IIF), by the end of the first quarter of 2022 global debt was estimated to be over $305 trillion and it is currently equal to 350% of global GDP. This is the direct result of reckless monetary and fiscal policies by governments and central banks the world over. Matthew Lynn, writing in the Spectator, says:

“It [the debt] has been going up every year, spurred on by central banks printing cash. When there was a link between money and gold, that was impossible. You would need a lot more of the metal than exists on this planet to finance all that borrowing.”[1]

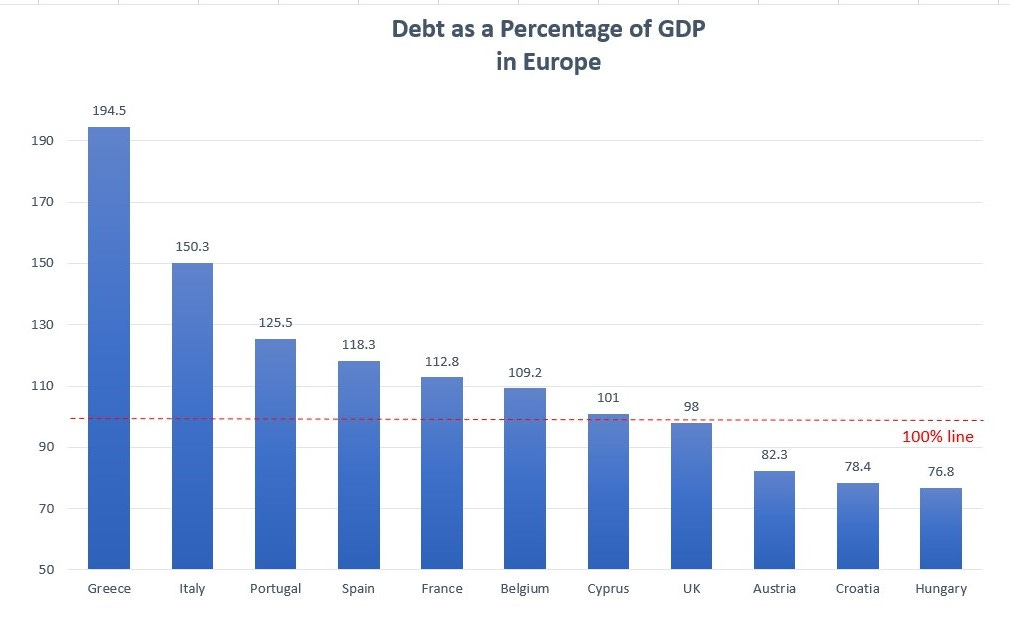

At the end of the first quarter of 2022, the government debt to GDP ratio in the euro area stood at staggering 95.6 percent.[2] Quoting the Washington Post, “This can’t go on forever. At some point, a major [European] government will probably end up insolvent.”[3]

Another country that deserves a mention on the topic of debt is Japan. By the end of 2021 Japan had a debt-to-GDP ratio of 262.5%. Using the debt to GDP metric, Japan is the second most indebted nation in the world with over $9 trillion (Venezuela is the first). Japan's debt began to swell in the 1990s when its finance and real estate bubble burst to disastrous effect. Japan's debt first breached the 100-percent-of-GDP mark at the end of the 1990s. It hit 200% in 2010.

In 1999, the euro entered into circulation, anchored by the ECB (European Central Bank) Europe realised that by tying all the major economies of Europe together under one multilateral, unified currency, they would have much more collateral and leverage than they had when using their own individual currencies, especially in trade, monetary, and fiscal matters. The euro and the structure of the euro zone area provided stable foundations for a more elastic currency that could compete with the U.S. dollar. Europe now has its own highly elastic, multilateral fiat currency, while this all sounds good on the surface it simply allowed Europe to descend deeper into the fiat vortex of perpetual deficits, insurmountable debt, and never ending monetary inflation.

The problem is that under a fiat monetary system there is simply no limit to how much currency can be printed and politicians use inflation to placate the citizenry in the short-term, absolve themselves of having to take responsibility in the present and pass that responsibility on to on to future generations who will have to contend with the real consequences of inflationary monetary policies such as scarcity, higher prices, and a debased currency, figuratively speaking robbing the future to pay for the present.

According to Jeffrey E. Garten, only Canada and West Germany wanted a floating currency system. All the other nations wanted the stability of a fixed system (with more flexibility to adjust the rates than the Bretton Woods system offered previously).

Latin American Debt Crisis

I explained in considerable detail in part one the disastrous effects that rising interest rates and inflation had domestically in the U.S. However, the consequences do not stop with the United States alone. When the chairman of the Federal Reserve, Paul Volcker, raised interest rates to a staggering 21% in order to finally conquer America’s long battle against inflation this, along with falling oil prices, set off a cascading effect across the developing world and the result was the Latin American debt crisis of the 1980s. Countries with dollar denominated debts saw the interest on their existing debts skyrocket as a result, causing economic chaos in Latin America and throughout the developing world. Exchange rates with the dollar deteriorated meaning that Latin American countries needed large volumes of their own currency to finance existing debts. Mexico, Brazil, Venezuela, and Argentina collectively owed various commercial banks $176 billion.

The crisis caused devastation across the region. In August 1982, Mexico declared that they could not service their debts and would have to default, its debt had climbed to $58 billion by then.[4] By 1986, Mexico’s foreign debt amounted to 78% of GDP and inflation exceeded 100%. The 1980s is known in Mexico as "La Década Perdida" ("The Lost Decade") and the exodus of people over the U.S. border fleeing appalling conditions continues to this day.[5] During the same period Argentina saw their debt climb to $65 billion, the Latin American debt crisis plunged the nation into political and economic turmoil. 400,000 companies went bankrupt and from 1989 to 1990 hyperinflation paralysed the country, which soared to a staggering 203% by which time food riots had broken out. Many feel that even to this day Argentina has never fully recovered.

The Latin American debt crisis was one of the most devastating economic crises in modern history. As a result incomes dropped, inflation soared, and unemployment and poverty both increased. Living standards deteriorated and crime increased and many were forced into prostitution, drug crime, trafficking, and even terrorism. Latin America experienced negative growth of almost 9%. Lastly, I would add that one of the most dominant narratives in mainstream political discourse in the United States today, that of the mass migration of people from Mexico and Central America over the southern border into the U.S., arguably started with the Latin American debt crisis (and continues to this day). The Latin American debt crisis was caused by the precipitous increase in interest rates from the Federal Reserve, action done to curb inflation, inflation that was the product of irresponsible fiscal and monetary policies of the U.S. government dating back to the 60s; you can see clearly the domino effect that being in a fiat monetary system causes when one single entity, in this case the Federal Reserve, exerts so much influence and control over the system and the value of the world’s reserve currency that when it raises interest rates it has a ripple effect throughout the world, the consequences of which can often be devastating.

Indeed, the era of global fiat currencies has seen one financial crisis after another envelop the world, nowhere is immune. The ‘Tequila Crisis’ of 1995 started in Mexico and grew to Brazil and Chile. The Argentine Great Depression was a four-year long recession that started in 1998 during which its economy shrank 28 percent and its debt more than doubled between 1995 and 2001.[6] The Argentine crisis spread to Uruguay, leading to the Uruguay banking crisis in 2002 in which one third of the country’s bank deposits were withdrawn. Russia would have its own financial crisis in 1998 leading to a devaluation of the ruble and Moscow defaulting on its debt, the crisis spread to other former Soviet states as well. Russia would go on to have another crisis between 2014-17. The Asian crisis of 1997 swept through Southeast Asia and parts of East Asia; GDP contracted (13 percent in Indonesia, 6.7 percent in South Korea, 10.8 percent in Thailand), unemployment soared (23 million people were left unemployed) and chaos swept through the economies of many nations.[7] Riots turned deadly in Indonesia where unemployment saw a tenfold increase. In South Korea the public were urged to turn in their personal gold that was melted down into ingots and sold on the international markets. Ecuador, India, Sweden, Finland, Turkey, Portugal, Greece, Venezuela, Iceland, Cyprus, and many others have all had their own economic crises of one kind or another. The 2008 financial crisis began with cheap credit and porous lending standards that fuelled a housing bubble. When the bubble burst, the banks were left holding trillions of dollars of worthless investments in subprime mortgages and toxic assets. Liquidity in the global economy had dried up and the government had to bail out banks deemed “too big to fail” with taxpayer dollars essentially passing the debt onto the public (a policy prescription the IMF often imposed on lesser developed nations during times of economic crisis in the past). It was the most severe global recession since the Great Depression. The system we have now sees endless boom and bust cycles that have devastating effects for many across the world. Irresponsible monetary policies lie at the heart of these crises, whether it be monetary policy from the central banks or the borrowing and spending habits of national governments, regardless, eventually everyone pays in the end.

The Federal Reserve

Any credible examination of the Nixon shock and the consequences of being in a pure fiat monetary system simply cannot ignore the role that the Federal Reserve and the central banks have. The creation of the fiat dollar has reinforced the power of the central banking complex over both the citizenry and the global monetary system. Keith Weiner explains that, “Nixon plunged the world into the regime of irredeemable currency, in which central banks have full control over the stock of money…”[8]

Central banks are essentially a monopoly of the big private, commercial banks who all coordinate and work together under one, centralised unit. Central banks do not act in the best interests of the people, they act in the best interests of their board members.

Though I have covered the Federal Reserve elsewhere in my writing, I think it is worth briefly looking at the role and function of the Fed and where it sits in relation to the Nixon shock. Under a fiat system the value of the dollar is determined – supposedly - by market forces (“market forces” in this case meaning supply and demand). But logically speaking, if that is indeed the case, then whoever exerts the most control over the market defacto controls the value of the dollar. Ultimately, the Federal Reserve has the biggest impact on market forces because only the Fed gets to determine the value of money as it controls both the supply and the interest rate. The Federal Reserve has total and absolute control to set value within the economy (this includes the value of goods, services, assets and even labour itself) and, by extension, determining market conditions as such, which no other institution can do as the Federal Reserve has a monopoly on money printing. It can grow and contract the money supply by decree and can inflate away the value of our money too, either by monetary inflation which involves bringing new units of currency into circulation (sometimes called quantitative easing) and by controlling the interest rate. The Federal Reserve acquired unrivalled power in the global economy as a result of Nixon’s decision to discard the gold peg; removing this final constraint on the Fed’s power effectively enabled the creation of new money, granting full elasticity to the money supply. As such, Nixon’s decision can be interpreted as a significant extension of the power of the central banking complex and particularly the Federal Reserve. Before exploring this further it is important to point out that, as a result of the 1944 Bretton Woods conference, the Federal Reserve was essentially in control of global monetary policy, being the sole issuing authority for the world reserve currency.[9]

Nixon’s decision afforded the United States, the Federal Reserve, and the broader Wall Street banking complex tremendous power and leverage in world affairs. The Fed employs a number of practices that are all predicated on cheap and easy money creation that would, realistically, be unthinkable without having a floating currency.

The first of these is called quantitative easing. This is where central banks pump artificial money into the system by buying up government bonds and, as a result, the cost of money (and borrowing) is rendered abnormally cheap. In response to the 2008 global economic crisis, the Federal Reserve went on an unprecedented spree of quantitative easing, adding trillions of dollars in assets to its balance sheet with expansionary monetary policies: by the end of October 2014, the Fed’s asset sheet had grown to $4.5 trillion in bank debt, mortgage-backed securities, and treasury notes.[10] The Fed’s inflationary policies in this period amounted to an artificial stimulation of banks and markets by both the Federal Reserve and other G7 central banks.[11]

Alongside quantitative easing, the Fed can employ a zero percent interest rate policy (called ZIRP for short), flooding the market with cheap credit in order to artificially liquify markets, keeping them solvent. This is exactly what happened in the aftermath of the 2008 crisis when the Fed used a zero percent interest rate for approximately 7 years until Fed Chairwoman Janet Yellen increased rates to 0.5%.[12] However, this can lead to dangerous and speculative asset bubbles as well as driving up inflation too.

During the 2008 global financial crisis, a new and controversial practice called dollar liquidity swap lines emerged, whereby the Federal Reserve extends significant lines of credit (in many cases, tens of billions of dollars) to the central banks of other developed nations to add liquidity to their markets. In return, these nations and their central banks are expected to be more accommodating to the Federal Reserve, to Wall Street, and to the United States generally. Obviously, this translates into significant geopolitical influence and it also strengthens the dollar’s position as the world reserve currency. Swap lines were used again during the COVID-19 recession in 2020.[13] It is often said that what is controversial isn’t so much who receives these swap lines, but who does not. Ultimately, it is virtually impossible to deny that the Federal Reserve’s power and influence grew exponentially as a result of the Nixon shock.

Finance capitalism is a term I use to refer to a change in the structure, direction, and output of capitalism in the developed world. After the Nixon shock came a number of developments that have reshaped many aspects of the economy and the world at large.

Growth in the treasury market – Shortly after the Nixon shock, the introduction of the petrodollar trade launched a parallel market for U.S. debt securities. A portion of the profits from oil sales by OPEC member states saw billions of dollars reinvested into the purchase of U.S. treasuries and bonds through the major Wall Street banks. Suddenly, the banks and money markets were flush with fresh liquidity and credit, and billions of excess dollars were then loaned out to the developing world via the World Bank.

Neoliberal reforms of the 1980s – During the 1980s, under the Reagan administration, the banking sector was heavily deregulated and banks took on a new prominence in the global economy. Banks were at the forefront of globalisation and the free movement of goods, capital and people helping markets expand across borders. The movement away from regulation reached its climax when President Clinton ended up repealing large parts of the Glass-Steagall Act that separated commercial banks from other informal lending institutions.

Shadow banking system – Shadow banking refers to financial institutions that are not subject to the same rules and regulations that normal banks are. It is estimated that the shadow banking system accounts for approximately $52 trillion worth of trade, many times more than trade in actual goods and services.[14] The shadow banking system was at the centre of the 2008 financial crisis when the subprime mortgage market collapsed leading to a global crisis. Shadow banking has pioneered various debt instruments and informal lending practices that are associated with higher levels of risk should global conditions deteriorate and credit dry up, these include: credit default swaps, collateralized debt obligation, special purpose entities, structured investment vehicles, and a whole host of other zombie financial instruments that even people in finance would be hard-pressed to define.

Speculation – In its most basic form, speculation refers to a high risk strategy of making a quick profit by taking advantage of short-term fluctuations in the market. Speculation can affect currencies, commodities, and even entire markets.[15]

Now, it is important to add that I am not saying that the 1971 Nixon shock caused all of the above, correlation does not necessarily equal causation after all, but it is definitely a significant contributing factor and what I have listed above is by no means exhaustive. It did not take long for this new system of floating currencies with floating exchange rates to attract manipulation by speculators and hedge funds. These changes all took place after Nixon’s decision and are all predicated on having an elastic currency whereby money creation has no constraints, the Nixon shock provided the foundations for all of these ‘innovations’ to happen. The fact that capital investment firms like Blackrock have $10 trillion in asset and Vanguard $7 trillion and have acquired so much power as a result, can be traced back to this moment, this would be unthinkable under a gold standard (incidentally, both the aforementioned firms were founded after the Nixon shock). With easy access to cheap, liquid capital, financial institutions could now enter largely deregulated markets ripe for investment and speculation.

These developments amount to a significant extension of the global American empire; providing new markets for the dollar to circulate in, increasing its strength and liquidity in the process, ultimately consolidating the U.S. dollar's position as the world reserve currency. Large commercial U.S. banks and other financial institutions now hold considerable influence in the world today and can advance U.S. interests abroad, by proxy, as a result. I will be submitting dedicated articles on the growth of finance capitalism later.

Jacques Rueff, a leading 20th century French economist, identified deeper and more chronic problems associated with monetary instability, problems that go far beyond the economy. When the government engages in deficit spending this invariably leads to inflation; the volatility and instability that inflation causes leads to what Rueff came to term as false rights. These false rights permeate throughout the economic and legal systems and across society in general, this in turn produces a citizenry with little respect for freedom, property, or the rule of law. Rueff was, in effect, saying that both the social and human capital deteriorates as the economic conditions around them decline thus governments have direct influence on civilisational development with the policies they employ. Rueff identified Weimar Germany as a prime example of this decay: as hyperinflation set in, the currency collapsed and living standards declined and there was a breakdown of basic norms and social order as a result. In its place came the unrivalled degeneracy of the early 20s. Berlin gradually became a hive of alternative lifestyles and unashamed sexuality: what began as an increase in prostitution soon developed into rampant homosexuality, incest, and even paedophilia. The city openly celebrated their decline into degeneracy with clubs featuring naked dance and theatrical performances whilst even homes were transformed into brothels. Unsurprisingly, drug use soared during this period as well with amphetamines, morphine, and cocaine being readily available. Magnus Hirschfeld, a homosexual physician and gay rights advocate, whose ideas would go on to do tremendous damage to the moral and social fabric of western civilisation, emerged out of Berlin during this period. Among the chaos, Germany would eventually turn to National Socialism for answers and some semblance of order and we all know how that finished. Rueff believed that history was repeating itself with the way the U.S. was issuing large volumes of dollars beyond what it could cover with gold, he called this the “monetary sin of the west”. The point Rueff was making is that the volatility that monetary inflation leads to causes economic problems which bring lasting social damage in its wake. Returning to the central problem, Rueff believed that only the gold standard denies central banks and governments from undisciplined and ruinous monetary policies.[16] Henry Hazlitt was another famous advocate of the gold standard, for Hazlitt the strength of gold lies precisely in its inelasticity which means it cannot be manipulated:

“The supply of gold is governed by nature; it is not, like the supply of paper money, subject merely to the schemes of demagogues or the whims of politicians. Once the idea is accepted that money is something whose supply is determined simply by the printing press, it becomes impossible for the politicians in power to resist the constant demands for further inflation.”[17]

Ironically, one of the main proponents of fixed rates and the gold peg was none other than Undersecretary Volcker himself. Jeffrey E. Garten says:

“Volcker believed that money needed an anchor… He was convinced that fixed prices imparted a necessary discipline on national policy makers, who otherwise would too easily resort to lax fiscal and monetary policies that would lead to inflation.”[18]

A program of sound money, where central banks are held to strict rules, would promote more stable economic growth, and reduce the concentration of gains accruing to the financial sector.

In a debt-driven economy where almost everyone is perpetually in debt it is difficult to know where we are headed and how this will end. The problem is that under a fiat monetary system there is simply no limit to how much currency can be printed. The current system of central bank-controlled money has led to massive instability and volatility, it has caused one global economic crisis after another, while our currencies have been systematically debased and robbed of their purchasing power asset prices have skyrocketed, and unimaginable levels of debt have been created in the process.

Analysts are quick to point out that returning to a gold standard just isn’t possible but this is precisely because of the conditions brought about by being in a pure fiat monetary system: the culture of credit and debt that is so ubiquitous that people hardly even stop to even question it, the debt-fuelled global economy, a culture of consumerism that commodifies everything it can and eviscerates everything that it can’t. The cultural and human cost, however, has been immense, the GDP line goes up but civilisation goes down.

The most unsettling thing is that we do not know where this is headed and where it will ultimately take us. We need to start asking some very hard and serious questions about the foundations of the global economic system we currently have. We have basically reached the stage now where the current system is simply unworkable without the debt component and reversing this will be very hard.

It is my strongly held belief that whether you are an Austrian, a Keynesian, a monetarist, whatever school of economic thought you subscribe to, whether you are a conservative or a liberal, you cannot ignore the effect that the 1971 Nixon shock has had on the world: the global economic system and the world more generally has been recast in its shadow.

Truth be told, this article was the most challenging subject I have encountered to-date. Evenings spent going through decades old balance of payments records, endless financial data, and one graph after another lead me to places I never thought I would go, asking questions the likes of which I had never even considered before all in an effort to try and make sense of the world that has unfolded since that fateful day in 1971.

Notes

[1] Lynn, M. (2022) How the ‘Nixon shock’ reshaped our economy. Available at: https://www.spectator.co.uk/article/how-the-nixon-shock-reshaped-our-economy/

[2] Government debt down to 95.6% of GDP in euro area (2022). Available at: https://ec.europa.eu/eurostat/documents/2995521/14644644/2-21072022-AP-EN.pdf.

[3] Europe’s Sovereign Debt Can’t Keep Going Up Forever (2022). Available at: https://www.washingtonpost.com/business/energy/europes-sovereign-debt-cant-keep-going-up-forever/2022/11/15/918224b4-64ab-11ed-b08c-3ce222607059_story.html

[4] Harvey, B.D. (2022) A Brief History of Neoliberalism by Harvey, David [Oxford University Press, USA,2007] [Paperback]. 1st (First) edition. Oxford University Press, USA. p.99

[5] Toussaint, E. (2008) The World Bank: A Critical Primer. Pluto Press. p.154

[6] Harvey, B.D. (2022) A Brief History of Neoliberalism by Harvey, David [Oxford University Press, USA,2007] [Paperback]. 1st (First) edition. Oxford University Press, USA. p.105

[7] Toussaint, E. (2008) The World Bank: A Critical Primer. Pluto Press. p.256

[8] https://keithweinereconomics.com/

[9] Prins, N. (2019) Collusion: How Central Bankers Rigged the World. Illustrated. Bold Type Books., p.88

[10] Wolfers, J. (2014) The Fed Has Not Stopped Trying to Stimulate the Economy. Available at: https://www.nytimes.com/2014/10/30/upshot/the-fed-has-not-stopped-trying-to-stimulate-the-economy.html?rref=upshot&abt=0002&abg=1.

[11] Prins, N. (2019) Collusion: How Central Bankers Rigged the World. Illustrated. Bold Type Books., p.56

[12] Curry, B. and Tepper, T. (2023) Federal Funds Rate History 1990 to 2023. Available at: https://www.forbes.com/advisor/investing/fed-funds-rate history/#:~:text=In%20late%202008%2C%20the%20Fed,the%202008%20global%20financial%20crisis.

[13] Gros, D. and Capolonga, A. (2020) Global Currencies During a Crisis: Swap Line Use Reveals the Crucial Ones. Available at: https://www.europarl.europa.eu/cmsdata/207608/CEPS_FINAL%20online.pdf

[14] Cox, J. (2019) Shadow banking is now a $52 trillion industry, posing a big risk to the financial system. Available at: https://www.cnbc.com/2019/04/11/shadow-banking-is-now-a-52-trillion-industry-and-posing-risks.html

[15] What is speculation and how does it affect your investments? (2022). Available at:

https://www.bankrate.com/investing/what-is-speculation/

[16] Jacques Rueff’s quest for monetary order (2022). Available at: https://engelsbergideas.com/essays/jacques-rueffs-quest-for-monetary-order/

[17] Hazlitt, H. (2015) Man vs. The Welfare State. Ludwig von Mises Institute. p.162

[18] Garten, J. (2021) Three Days at Camp David: How a Secret Meeting in 1971 Transformed the Global Economy. Harper. p.84