Our Current Economic Malaise

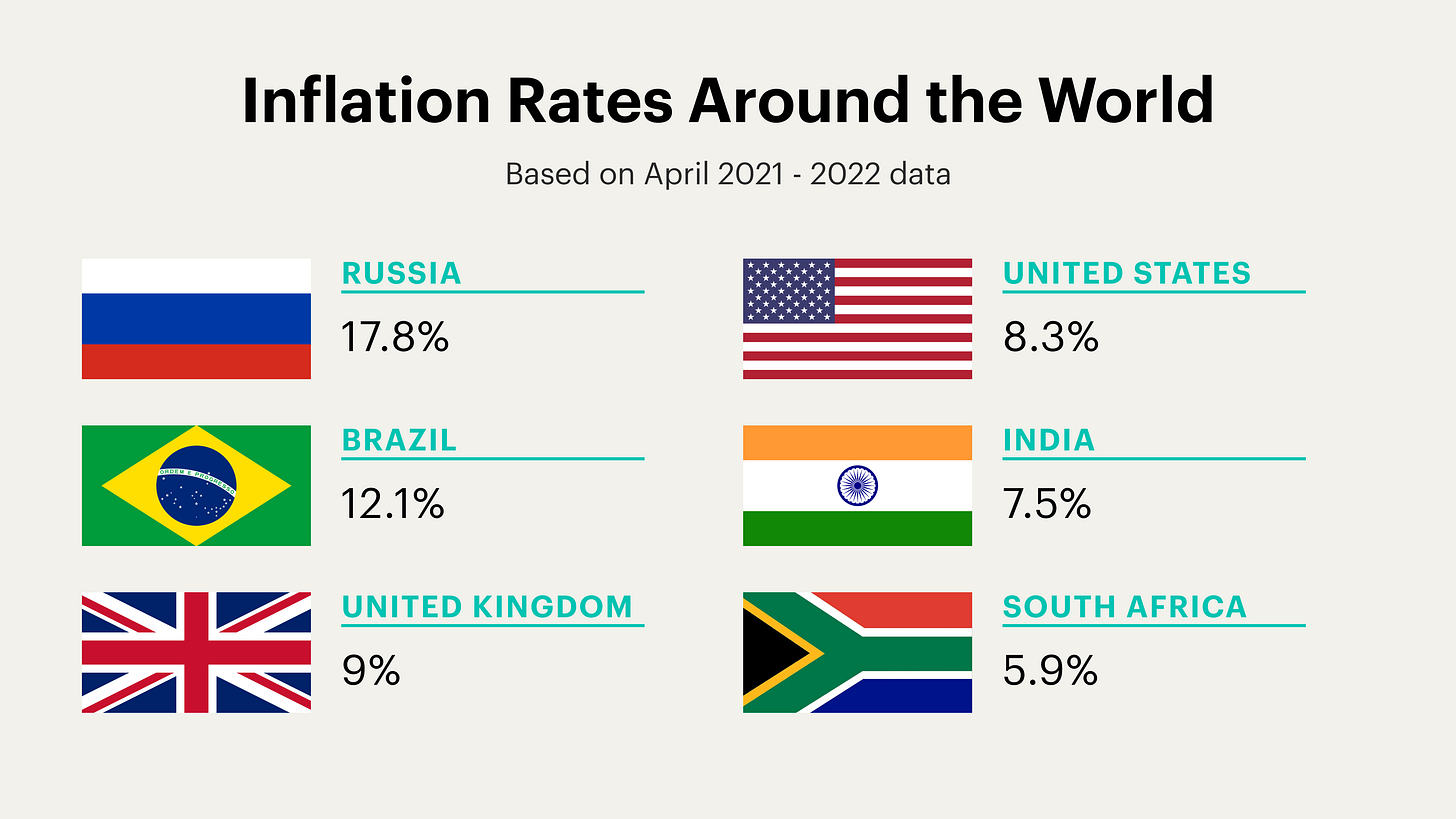

Debt is out of control. Inflation is out of control and reached double-digit levels in many countries. So, what is going on and how did we get here? There is no easy or simple explanation and there are many push and pull factors stretching as far back as the 2008 global financial crisis. In 2021, current Treasury Secretary Janet Yellen called the risk of inflation "small" and "manageable". The Federal Reserve Chairman Jerome Powell stated that inflation would be "transitory". This has not proved to be the case. Many countries have had to contend with record levels of inflation which has resulted in a cost-of-living crisis exacerbated by soaring energy and commodity prices; the result of war, unprecedented levels of monetary inflation from central banks and geopolitical events too. As I write this now, we are on the brink of a worldwide recession. The United States had been battling price increases in oil, food and housing long before the Russia-Ukraine conflict broke out. By May 2022, inflation stood at 8.6% in the U.S. and although it has been slowly declining it was still at 6.4% by January 2023.[1]

Many countries in Europe have experienced their worst levels of inflation in decades. In the UK, inflation hit a record 40-year high of 11.1% in July 2022 and interest rates reached their highest level in 14 years when they were raised to 3.5% by the Bank of England.[2] Germany posted its worse inflation figures since the 1950s, reaching 8.8% in October 2022. In France, inflation rose to 7.1%, the highest recorded in three decades. Belgium, the Netherlands, Italy and Turkey all had to contend with double-digit inflation. In the Eurozone as a whole, inflation reached 10.7% by October 2022, the highest since its formation in 1999.[3] In response, the ECB (European Central Bank) decided to raise rates for the first time in 11 years and the euro fell below the dollar for the first time in 20 years.

Generally speaking, the developed world provides most of the demand for many of the commodities and natural resources from the developing world, so when large trading blocs like the Eurozone and countries like the United States, the UK and Japan are faced with economic problems this has serious consequences for the global economy; invariably, this leads to a decline in imports and regions and markets that export heavily to the U.S. and the Eurozone see a corresponding decline in revenues as a result. This is exactly what has taken place. At the time of writing in Australia, the UK, Germany and Italy inflation is still high lying between 5% and 7%, the U.S., Canada and Japan are faring better where it is around the 3% mark.

It is convenient to blame the current economic crisis on China and Russia; namely groups that are firmly outside the circle of the elites we have in the West but the truth is that the origins of our current malaise stretch back further than COVID and the Russia-Ukraine war.

The 2008 Global Financial Crisis

In response to the 2008 global financial crisis, the Federal Reserve went on an unprecedented spree of money creation in order to add liquidity to the global economy and to provide the necessary capital to banks and other financial institutions that were in danger of either defaulting or collapsing outright.

This came in many forms: quantitative easing (QE), zero interest rate policy (called ‘ZIRP’ for short) and dollar liquidity swap lines.

Quantitative easing (QE) – a process whereby the central bank purchases government securities, this reduces interest rates and increases the available money supply, freeing up capital for banks and allowing them to lend money at better rates and to invest more freely.

Zero interest rate policy (ZIRP) – a policy that renders credit very cheap, literally at 0% rate of interest attached.

Dollar liquidity swap lines (central bank swaps) – lines of cheap credit issued to other G10 central banks in order to liquify their markets. This was estimated to be somewhere in the region of trillions of dollars.

The Federal Reserve employed ZIRP and QE to buy government bonds and flood the markets with liquidity. However, the private banks that were the recipients of this cheap credit went on to create huge asset bubbles and continued speculating (in search of high returns). The Fed pressured other G7 central banks to do the same thing.

The U.S. had 7 years of ZIRP from 2008 to 2015 until the rate was raised by Fed chairwoman Janet Yellen. Between the start of the crisis and October 2014 the Fed doubled the size of its balance sheet: from $2.1 trillion to $4.4. primarily because in order to keep rates at 0% the Fed had to buy trillions of dollars of mortgage and U.S. Treasury bonds and to liquify markets.[4]

In the aftermath of 2008, many countries have seen record levels of debt and no G7 country has reduced its debt-to-gdp ratio since. The flood of cheap money led to trillions of dollars in debt, rising to a staggering $325 trillion worldwide, more than tripling worldwide debt.[5]

Another significant development occurred in the aftermath of the 2008 crisis, China started reducing its purchases of U.S. treasuries and started investing in other assets and commodities, particularly gold, and by 2014 Japan replaced China as the country with the largest portfolio of U.S. debt assets. Alongside this, China has started to internationalise the yuan as an alternative to the U.S. dollar by gradually reducing currency controls and facilitating more international trade in the yuan (more on this later).

The main point to understand here is that central banks across the world have been engaging in reckless monetary policy for a long time now and the results of these policies are catching up with us now.

The record levels of monetary creation in the aftermath of the 2008 crisis set the stage for a series of events that have collectively led to our current financial malaise.

COVID-19

First comes the various COVID-19 stimulus programmes that were carried out around the world. America’s response to the COVID-19 pandemic saw trillions of dollars added to the U.S. economy. Estimates vary, Wikipedia states that the stimulus package was $1.9 trillion but The New York Times claims it was $5 trillion. The European Union took similar measures, its recovery plan was over €2.3 trillion and included an initial €750 billion stimulus package, an enhanced long-term budget of over €1 trillion and €540 billion in emergency support. For the UK, the stimulus is estimated to be between £310 billion to £410 billion.[6] The stimulus package announced by the Bank of Japan was around ¥117 trillion ($1.1 trillion).[7] The list goes on.

The aggressive monetary inflation that has taken place in response to the COVID pandemic has happened in a relatively short amount of time and problems to do with inflation are unavoidable as such. Furthermore, these measures come fresh on the back of record levels of conjured money being pumped into the world economy by central banks in response to the 2008 crisis, this point cannot be ignored.

Russia-Ukraine conflict

Russia’s invasion of Ukraine in early 2022 saw a sudden increase in the price of oil, natural gas, grain and fertilizer. Ukraine accounted for 11.5% of the world’s wheat crop and 17% of the world’s corn crop, the invasion meant that these supplies were cut off from the international market causing global shortages and prices to rise. Immediately after the invasion commenced, the price of Brent crude oil rose from $97.93 a barrel to $127.98 per barrel. The invasion resulted in Russia getting sanctioned and removed from the SWIFT banking system which meant a tremendous amount of trade and liquidity moving off the dollar and onto other currencies as a result. Thus it is important to recognise that Russia’s invasion of Ukraine has not only led to a sharp increase in the price of essential commodities but has also reduced demand for the U.S. dollar too. The U.S. froze roughly half of Russia’s central bank reserves and $330bn dollars of Russian assets too. Meanwhile, strong demand from American buyers has pushed up the price of oil and other essential commodities even more.

De-dollarisation - increasing movement away from the U.S. dollar

Somewhat ironically, Russia being removed from the SWIFT banking system by the U.S. has marked a broader departure away from the dollar in the international community (with many countries seeking bilateral payment schemes between each other in their own currencies). In response to Russia being sanctioned, China has stepped in to fill the void by offering up its own financial network as an alternative destination for Russian money. Since 2010, China and Russia have settled the majority of their oil transactions in yuan and rubles, not dollars. Similarly, China and Brazil have reached an agreement to move away from the dollar and to trade in their local currencies with Brazilian premier Lula de Silva a vocal critic of the dollar system. China is now Brazil’s number one trading partner with bilateral trade estimated to be worth hundreds of billions of dollars and rising.

Prior to current events, China reducing its purchase of U.S. treasuries and capital controls on the yuan slowly being lifted have also contributed to de-dollarisation. Currently, China’s holdings of U.S. Treasuries are at their lowest level in decades.[8]

Recently, China completed a currency swap deal with Argentina, worth approximately ¥130 billion ($19 billion) and Buenos Aires now settles its imports in Chinese yuan and has discarded the dollar from these transactions in a bid to safeguard their dwindling supply of dollars after unprecedented droughts led to declining exports. Bilateral trade between India and Russia is estimated to be $45 billion and the two countries use their own currencies to conduct trade in, bypassing the dollar altogether.[9] Meanwhile ASEAN (The Association of Southeast Asian Nations) has pledged to gradually move away from the dollar as well. Already, Russia and Iran pay for roughly 60% of their trade in Russian rubles or Iranian rials.

The BRICS trading bloc (BRICS is an acronym for Brazil, Russia, India, China and South Africa) have agreed to conduct transactions using their own currencies and potentially creating a unified BRICS currency. Iran, Argentina, Saudi Arabia and others have pledged to join the organisation too. Where this momentum will lead, we cannot say, only time will tell, but the signs aren’t good for Washington.

Shockingly, in 2023 the Saudi Arabian finance minister Mohammed Al-Jadaan said the country was open to doing oil deals in currencies other than the U.S. dollar. Saudi Arabia and China are moving closer and closer together as a result of both the belt-and-road initiative and the fact that China now purchases about 25% of Saudi Arabia’s oil. Saudi Arabia is the most influential member of OPEC, so Riyadh and Beijing moving closer together may spell bad news for the future of the petrodollar, one of the key components of the broader dollar system.

The sanctions against Russia not only moves large volumes of trade in oil, gas and other commodities off the dollar and on to other currencies, it also sends a warning signal to the international community that their assets and holdings could be under threat as well. Sanctions by the U.S. have increased by 900% since 2000 and many believe that the threat of sanctions has probably accelerated movement away from the dollar.

Although it is unclear how all of this will play out, what is clear is that more and more countries are moving away from both the United States and the U.S. dollar, effectively resulting in a realignment of the current world order.

Reduction in U.S. Treasury purchases

Lastly, we have the Federal Reserve making record purchases of U.S. bonds in response to global demand for U.S. debt securities drying up, this has led to yet more inflation. From June 2020 to October 2021, the Federal Reserve bought $120 billion of treasuries and other securities each month. During 2022, foreign demand for treasuries fell by 6%, owing to higher interest rates and a strong U.S. dollar. When there is no demand, the Fed parachutes in and provides artificial demand in the form of large Treasury purchases.

In this scenario, the Fed is essentially a domestic creditor and at some stage in the future the money creation that enables such large purchases of U.S. treasuries is going to lead to problems with inflation in the domestic economy.

And this inflation is steadily eroding the value of the dollar. The rate of inflation is higher than the fixed rate of interest creditors are receiving on their U.S. debt assets and this is exactly why purchases of U.S. bonds are on the decline because inflation is steadily devaluing them. The PBC (People’s Bank of China) cited this very reason why it reduced U.S. Treasury purchases. From the perspective of the creditor, if they are losing money on their existing portfolio of U.S. debt assets then it is counterintuitive to expect them to invest in more of them. As it is, Washington already spends $726 billion annually to service its existing debts (14% of all federal spending).[10] Amid rising interest rates and falling demand it would be unwise to take on yet more debt especially when many countries are experiencing economic problems of their own.

As mentioned previously, a strong U.S. dollar has also played a part in this cycle. The Federal Reserve hiked interest rates to contend with rising inflation and this led to capital flight into the U.S. and raising the value of the dollar in the process. Countries that have traditionally been reliable buyers of U.S. debt have had to contend with their own economic problems and this has reduced the purchases of U.S. treasuries as a result. A devalued euro and pound will invariably affect the ability of those countries to enter the bond market and purchase U.S. Treasury bills just as it affects their ability to buy American goods and services more generally. Meanwhile, China’s purchase of U.S. Treasuries has been declining for the last three months and, as previously mentioned, is at a record low-levels.[11]

The problems do not end there because fewer bond purchases, in turn, affect America’s ability to buy goods and services in the global economy as well. It goes without saying that exports to the U.S. form a significant part of the economy of many countries and large purchases of U.S. government-backed Treasury bonds enable a lot of the trade that Washington has with the outside world.

There are several problems for the United States that we need to consider. Firstly, this scenario could lead to a full-blown debt crisis. A debt crisis is when a government needs to take on new debt in order to pay back existing debts and also when it has to cut spending or raise taxes in order to increase revenues. An even greater problem is that if countries are losing money on their assets they may start selling them off. At this juncture, countries are not willing to hold onto these bonds nor are they prepared to buy new ones, and why should they?

Conclusion

All this casts tremendous doubt over the future of the dollar and the United States’ ability to defend the dollar and provide safe and reliable financial assets. Its inability to do so will mean that countries may start turning away from the dollar as the currency of choice. The signs for the U.S. are hardly encouraging. The problems are starting to mount up for Washington and where it will lead is anyone’s guess. We could be watching the early stages of a period very similar to the 1970s. We could even be watching the beginning of the end of the U.S. dollar’s position as the world reserve currency.

Notes

[1] BBC News (2023) “US inflation stays high as housing costs bite,” BBC News, 14 February. Available at: https://www.bbc.com/news/business-64639662.

[2] UK inflation hits 41-year high of 11.1% as food and energy prices continue to soar (2022). Available at: https://www.cnbc.com/2022/11/16/uk-inflation-hits-new-41-year-high-as-food-and-energy-prices-continue-to-soar.html#:~:text=U.K.%20inflation%20hit%20a%2041,food%20prices%20continued%20to%20soar.&text=LONDON%20%E2%80%94%20U.K.%20inflation%20jumped%20to,to%20squeeze%20households%20and%20businesses.

[3] Hannon, P. (2022) “Eurozone inflation rate rises to 10.7% as recession looms,” WSJ, 31 October. Available at: https://www.wsj.com/articles/eurozone-inflation-rate-rises-to-10-7-as-recession-looms-11667210401.

[4] Prins, N. (2019) Collusion: How Central Bankers Rigged the World. Illustrated. Bold Type Books., p.259

[5] Prins, N. (2019) Collusion: How Central Bankers Rigged the World. Illustrated. Bold Type Books., p.3

[6] https://commonslibrary.parliament.uk/research-briefings/cbp-9309/

[7] KPMG (2020) “Japan,” 13 April. Available at: https://kpmg.com/xx/en/home/insights/2020/04/japan-government-and-institution-measures-in-response-to-covid.html.

[8] China cuts US Treasury holdings to lowest level since global financial crisis (2023). Available at: https://www.scmp.com/economy/china-economy/article/3213701/chinese-holdings-us-treasury-securities-falls-us8594-billion-lowest-2009-amid-rate-hikes-and-tension.

[9] Briefing, R. (2023) India and Russia: The 2023 trade and Investment Dynamics - Russia Briefing News. Available at: https://www.russia-briefing.com/news/india-and-russia-the-2023-trade-and-investment-dynamics.html/#:~:text=In%20turn%2C%20India%20exported%20goods,textiles%20and%20footwear%20(7.31%25).

[10] Fiscal data explains the national debt (no date). Available at: https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/.

[11] China cuts US Treasury holdings to 14-year low amid persisting security concerns, geopolitical tensions (2023). Available at: https://www.scmp.com/economy/economic-indicators/article/3231288/china-cuts-us-treasury-holdings-14-year-low-amid-persisting-security-concerns-geopolitical-tensions.