Line Go Up

How the elites benefit from mass immigration: part one

1 in 6 people in the UK were born overseas.

700,000 Polish-born people are in the country.[1]

Between 2001 and 2020, net migration accounted for 60% of the UK’s population growth.[2]

Since 2000, the UK has had a minimum of 150,000 people net a year, every year.

There has been more immigration to the UK in the last 25 years than in the previous 2,000 years prior, combined.

We have all seen the headlines and they get more and more sensational every year. The numbers keep rising. So, what is happening and how can we make sense of all this? After watching this excellent video from the Lotus Eaters and after seeing the recent events in Lampedusa, Italy, unfold I felt compelled to get to the bottom of why exactly our elites are so keen on immigration.

It is my contention that the ruling class, and by ruling class l mean our elites in government, business, and banking, see immigration as a primary driver of GDP from which they benefit. Mass immigration is sold to the public as being good for the economy and thus good for everyone but this is simply not true; a higher GDP does not benefit everyone equally. It is evident to me at least that some are benefiting more than others. As well as explaining how the elites benefit from immigration, I will also try and demonstrate how we, the citizenry, do not benefit from it.

The consequences of immigration such as the tremendous social and cultural impact it has, the huge demographic changes that have occurred as a result, rising crime, and increased racial and religious tensions will not be dealt with here as these are different topics altogether and ones that have been covered extensively elsewhere. This is a semi-rational explanation of how the elites benefit from immigration.

Before commencing, it is important to address some semantic issues first. By ‘British economy’ or ‘UK’ I mean the country as a whole, not just the elites in government and high finance. This important distinction will become more apparent as we go along but just because we have a better stock market and higher asset prices this doesn’t equate to the country as a whole doing better.

I would like to state unequivocally that whilst the elites in government and finance benefit and profit from immigration, immigration is bad for the country as a whole and bad for people in our spheres who would like a return to traditional, normal life.

Proposition 1

Immigration is good for GDP

The more people in the country the higher the GDP. That is, the more people there are in a country the greater the amount of economic activity taking place. This is a direct result of higher demand for goods and services (sometimes called aggregate demand) and ultimately more money being spent in the economy. The larger our GDP, the weightier the UK is in the world.

When immigrants arrive on our shores, they bring with them large amounts of capital - capital that is sourced from overseas - that gets invested into the country, raising the GDP in the process (tourists and international students are good examples but, in many cases, so are those who come to work). This is probably the reason why the Conservative Party has opened the borders to record numbers of foreign students (500,000 visas for foreign students were issued last year alone): overseas education is big business and in 2018-19, international students contributed a net £25.9 billion to the UK economy.[3] Tourism is as well, adding £131 billion to the British economy in 2021.[4]

Immigration = higher GDP + more economic activity + more money coming in from abroad

I will begin by looking at the relationship between immigration and economic growth. The relationship between immigration and economic growth is debated endlessly back and forth in the media and by politicians, academics and the general public. However, removed from the highly charged, emotionally driven debates, it is difficult to conclusively say that immigration has had any positive impact on the UK economy. There is a lot to cover in this first proposition, I will begin by addressing (and refuting) the widely held assumption that immigration is an economic benefit to the British economy as this leads nicely on to the main point that immigration really only benefits our elites, those at the very top of the economic pyramid.

By definition, immigration means more people and that means more goods and services being traded which will lead to gains in GDP. However, just because GDP is rising this doesn’t mean that everyone in society is benefiting from this. As I will go on to demonstrate in this series, it is evident that the benefits of immigration are not evenly distributed and some are clearly benefiting more than others.[5]

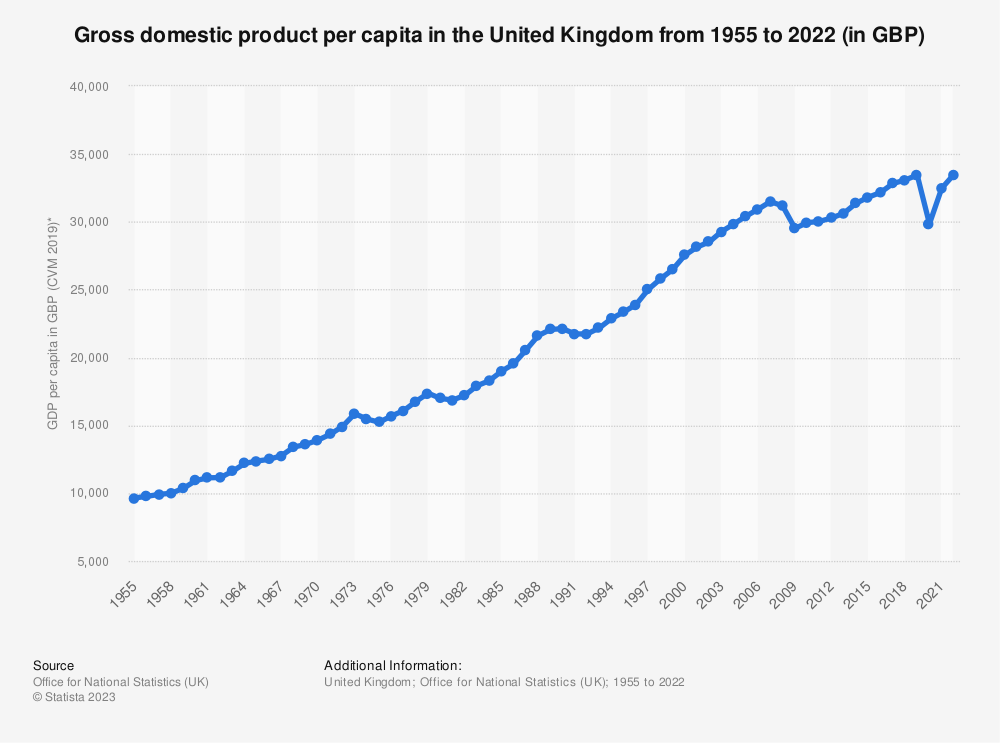

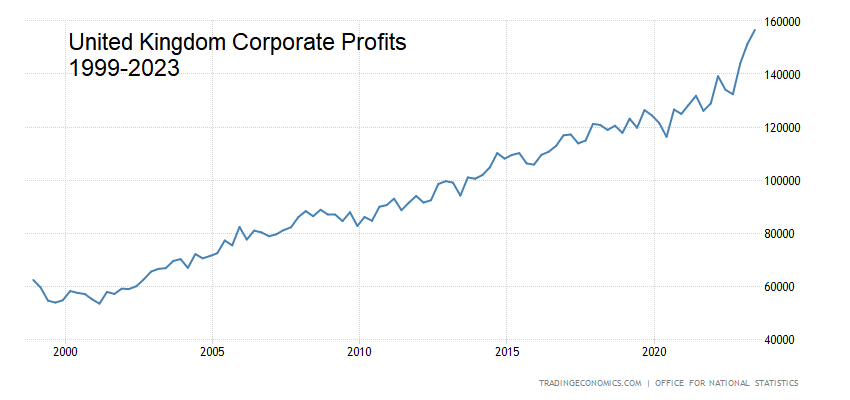

There are many ways to measure economic growth, however by examining two metrics in particular – GDP per capita and real wages – it is evident that there is little growth in the UK economy and that real wages have flatlined for over a decade now. Adding a third metric, corporate profits substantiates my claim that it is the elites who benefit.

When looking at the financial data, one should be paying attention to the real figures as opposed to the nominal ones because with real GDP the numbers are adjusted for inflation (nominal figures are not). The increase in real GDP per capita has been small:

UK GDP per capita for 2007 was £31,493

UK GDP per capita for 2022 was £33,497

This is an increase of just £2,004 in 15 years.[6][7] *

Real wages are another indicator of growth:

UK real wages for December 2007 was 1.7%

UK real wages for July 2023 was 0.6%

So real wages have declined by 1.1% since 2007.[8][9] As a point of reference, before the onset of the COVID-19 pandemic, in December 2019 real wages were exactly 1.7% - the same as in December 2007. In the United Kingdom, household income has not risen for 15 years during which time immigration has remained high.

So where is this growth and where are these wonderful economic benefits that the left speak so glowingly of? It remains a mystery, or does it? Well, buried deep among the data there is some evidence of growth but what this demonstrates is that if there has been any growth at all it has accrued to the elites only - not the country as a whole. This is because amongst all this stagnation one thing that has risen is corporate profits. Corporate profits have increased consistently in the 2000s, having almost doubled since 2007.[10]

I am not alone in believing that most of the benefits of growth accrue to those at the very top. An incredible amount of research supports the claims I referenced above that real wages have not increased in the last two decades but profits for global corporations and salaries for CEOs certainly have.[11][12] In fact, there is a very good book on this very subject called The Expendables by the Canadian author Jeff Rubin, in which the author explains that globalization has led to the dispossession of the middle class. Ruben argues that globalization has led to higher profits for companies, higher salaries for CEOs and, where applicable, higher bonuses and dividends too. Now, Ruben is talking about globalization but cheap labor, whether through immigration into Western countries or through offshoring factories abroad, is cited as a big factor.[13]

Aside from how immigration benefits the elites, it is evident from the data that you cannot conclusively say, beyond all reasonable doubt, that immigration has been an economic benefit to the United Kingdom (as many on the left would have us believe). It is important to remember that prior to the Blair years and the start of mass migration, trends were the same from then right up until the start of the 2008 global financial crisis and followed a very consistent line.

In conclusion, we can see that whilst determining growth is challenging, offering up different conclusions along the way, when we probe further we find that what growth we have had has accrued, unsurprisingly, to the elites because the only metric that has significantly risen is corporate profits and it is only logical to surmise from here that this is why the ruling class are so keen on immigration.

Proposition 2

GDP growth is correlated with a strong financial sector, more investment, and high asset values

The UK’s economy is dominated by the financial sector. Though a strong financial sector is important to every economy across the world, this is more so in the case of the UK because total financial assets are over ten times that of annual GDP.[14] Furthermore, the City of London is one of the main centers in global finance, and in order to maintain this position it demands that growth and GDP remain high at all costs; immigration increases the amount of financial transactions in the country, providing more liquidity to the markets. Financial assets (like stocks and shares) are also strongly correlated with GDP, meaning that if GDP is high then you can expect asset prices to be high as well.[15]

Immigration = a stronger financial sector + higher asset prices

The UK is dominated by a London-centric economy with the City of London at its center. The City of London’s position in global finance is underlined by the fact that a fifth of global banking transactions are booked in the UK, it is the center for the Eurodollar market and LIBOR, the home of the London Stock Exchange (including the FTSE 100), with a number of offshore low tax havens to call on, all anchored by the strength of the pound sterling. Additionally, London hosts the largest asset management industry and many of the most important equity trading platforms in Europe as well.[16] These are optimal conditions for banking, trade, and investment, and maintaining a high GDP is essential to all this, keeping markets liquid and pushing up the value of assets.

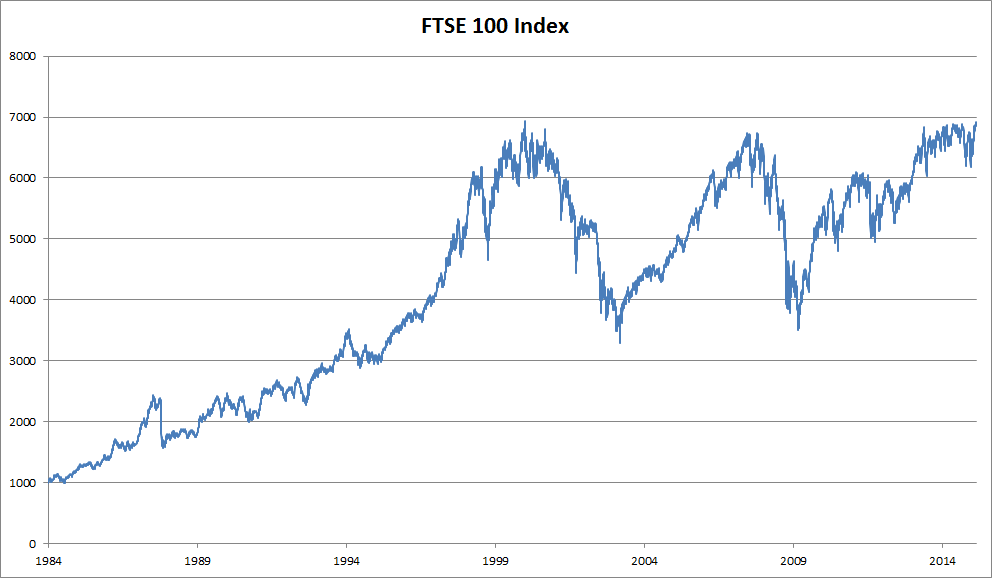

A higher GDP says to investors that this is a healthy economy to invest in. Posting strong growth figures leads to more investment coming in from abroad as overseas corporations and individuals invest in a variety of assets; successful, high-earning investments lead to more investment and all of this pushes up the GDP. High asset prices benefit those in power and the UK is seen as an investors’ paradise as far as investment in financial products is concerned. It should also be mentioned that all this investment raises the value of the pound as well, realistically how could it not? In 2021, total financial asset holdings were $36.5 trillion.[17] Here is a graph of the FTSE 100, the most widely used UK stock market index, showing the market value of the top 100 companies in the United Kingdom, as determined by their collective share price.

Too much money in the economy can lead to asset bubbles forming and this is exactly what has happened in the UK and is one of the reasons why we have a near-permanent housing bubble. Annual foreign investment in UK property was £35 billion in 2022 but has traditionally been higher. According to Statista, average house prices in the UK have increased by over 200% since 2000.[18]

It can be reasonably argued that our political and banking elites are two sides of the same coin (pun firmly intended). In the year after the 2010 general election, half of the Conservatives' funding came from the financial sector, with hedge funds and private equity firms leading the way, collectively contributing £6.2m in total.[19] More recently, between 2020 and 2022, the Conservatives received over £11m in donations from the City of London.[20] A report by Open Democracy revealed that an elite cabal of donors from the City of London, referred to as the Leader’s Group, gave more than £50 million to the Conservative Party between 2010 and 2019, whilst wealthy hedge funds have collectively given in excess of £18 million.[21] George Osborne, Rishi Sunak, and others have deep ties to the City of London and global finance; Osborne has advised the U.S. asset management firm BlackRock and the venture capital firm 9Yards Capital, meanwhile, Sunak has worked at various hedge funds and investment firms, most notably Goldman Sachs between 2001 and 2004. Former Prime Minister Theresa May and cabinet minister Savid Javid have both given speeches to JP Morgan and other leading financial firms, receiving substantial six-figure sums for doing so, meanwhile, former Prime Minister David Cameron now lobbies on behalf of Greensill Capital.

When individual donors contribute more than £50,000 they are entitled to a one-to-one meeting with the Prime Minister. We can only speculate what gets discussed at such confidential meetings but one imagines that keeping GDP strong must be high on the list.

The strength of a country’s financial markets necessitates strong growth and a high GDP. As immigration is one of the primary drivers of GDP it isn’t too much of a stretch to conclude that those in high finance would be partial to higher levels of immigration as a way of growing GDP for their benefit. There are over 250,000 millionaires in London, many of whom come from high finance and if the government is not accommodating to their wishes, then they may see fit to withdraw their assets and investments from London in search of a more favorable setting such as Frankfurt or Amsterdam.[22] Those in the City of London will never complain when the size of their market expands, it just so happens that their market is the population itself: more people means more spending in the economy, more borrowing, more credit, higher demand etc. As the patricians of this system, the elites in high finance are, after all, the primary beneficiaries under this arrangement and this is why immigration continues despite the government consistently pledging to reduce it.