Empire of Dollars 3

How the United States maintains control of the global monetary system - part 3: The liquidity of the U.S. dollar

3. The liquidity of the U.S. dollar

Liquidity refers to the ease, accessibility, speed and efficiency that a currency can be bought and sold without causing a significant loss of its purchasing power. A currency is said to have a high amount of liquidity if it can be traded easily.

The liquidity of a currency is correlated with how strong and stable a currency is. A currency is swapped and traded easily because investors see it as a safe and reliable investment hence a strong currency. A large part of how strong and reliable a currency is is how investors perceive the government and central bank of that currency; in particular, the central bank’s ability to act as a lender of last resort and being able to guarantee both their assets and liabilities in the event of a crisis.

Ultimately, the more trade that is conducted in that currency the more liquid, secure and strong that currency is likely to be. Liquidity is also used to describe assets and how easily they can be converted into cash. The more liquid a currency is the more likely investors are to trade and invest in that currency (including in assets denominated in that currency). This is very much a self-reinforcing cycle: the more liquid a currency is the more likely that both official and private organisations are to invest in it; this strengthens the currency by – over the long-term - raising its value and making it more liquid as a result.

The liquidity of the U.S. dollar is simply unparalleled and, as things currently stand, there is no other currency that could seriously challenge the dollar’s hegemony and position as the world reserve currency. The source of all this liquidity comes from the dollar’s role as the world reserve currency, the dollar is the dominant currency across a range of markets: in international banking, for foreign currency reserves, for oil and other commodities, in the shadow banking system and many more.

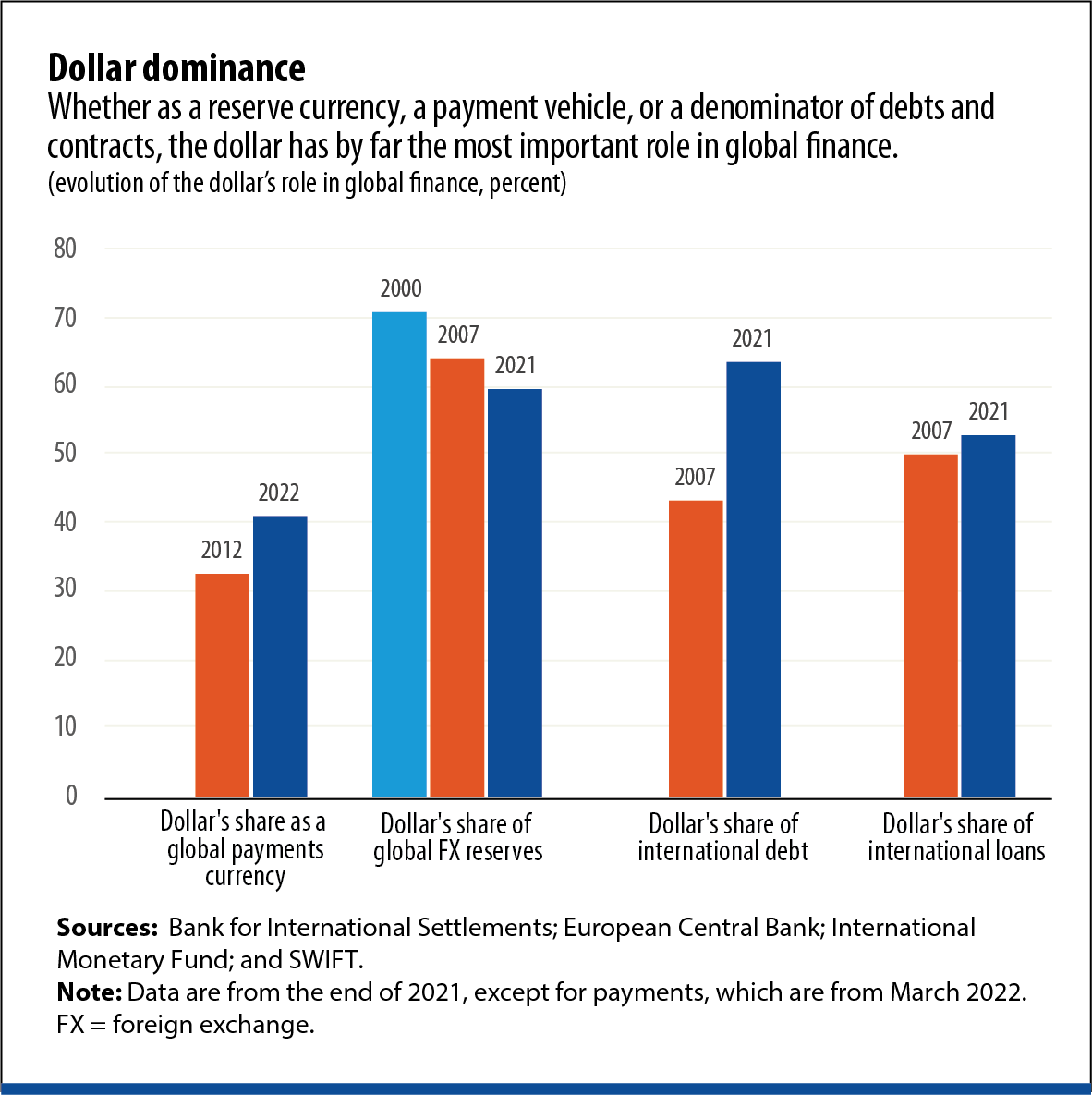

It is estimated that at least 90% of world trade happens in U.S. dollars. Consider, also, the following:

Around $7.5 trillion is traded on the foreign exchange markets daily and the U.S. dollar is used in 85% of these transactions;

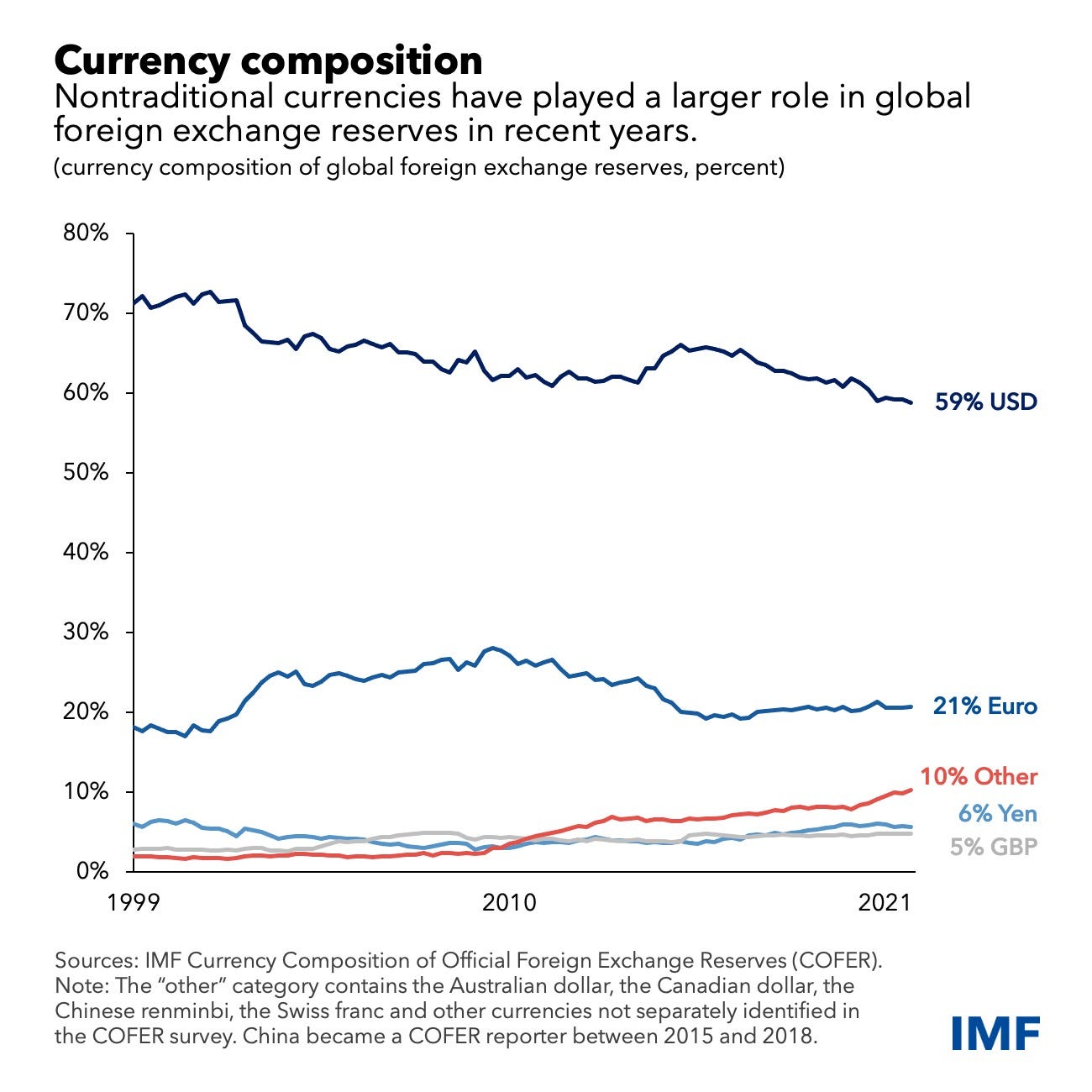

59% of foreign currency reserves are in dollars;

Approximately 40% of global debt is denominated in dollars;

$600 billion is traded daily in U.S. treasury bonds;

One quadrillion of dollars is traded annually.

In terms of foreign currency reserves held in central banks, though the dollar’s share of central bank holdings has declined it is still by far the most dominant currency in this area, with the dollar accounting for 59% of central bank reserves. The euro is second with 21% of central bank holdings, then comes the Japanese yen with 6%, the British pound with 5% and China with 2.8%. Capital controls from China and Japan (that stem from a widely held belief in those nations that large build ups of their currency outside of their national borders is best avoided) means that a seismic shift in this area, as things stand, is unlikely.

Many countries price their exports in dollars even when only a fraction of those exports end up in the U.S., that is simply the reality of the global economy today. As a frame of reference, consider that 86% of India’s exports and 70% of Australia’s exports are invoiced in dollars even though only a small percentage of these are destined for the U.S. The dollar is by far and away the world's most frequently used currency in global trade. When India provides IT services to a tech start-up in Argentina, they do not pay in Indian rupees or Argentine pesos, they pay in dollars. When South Korea sells Hyundai cars to New Zealand the Korean won and New Zealand dollar are not part of the transaction, the U.S. dollar is used instead. This is because the effective demand for the respective currencies mentioned above is, for a number of reasons, low in comparison with the U.S. dollar. Argentine pesos and New Zealand dollars are not as widely accepted as the U.S. dollar is so by accepting payment in an alternative currency a nation is disadvantaging themselves when all the other nations are using dollars. The dollar system ensures that even when the U.S. isn't directly part of the transaction the U.S. dollar is still used as the medium of exchange for most exports and commodities, a primary reason for its high liquidity.[1] In fact, the dollar’s share as an invoicing currency is 3.1 times its share of world exports.[2]

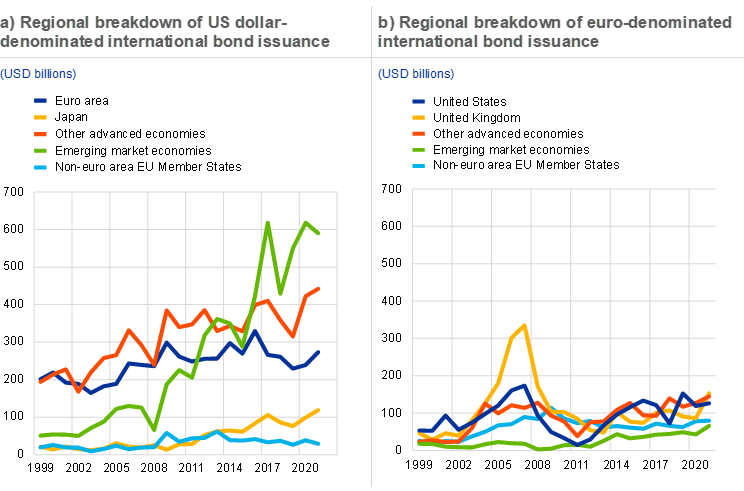

The only currency that has offered any kind of competition to the dollar is the euro and although since its introduction in 1999 a lot of liquidity has passed onto the euro it is yet to dethrone the dollar. Like many currencies, the euro has had its ups and downs: it performed well from the outset and benefited tremendously from the recession in the U.S. in the early 2000’s but the 2008 crisis brought on a recession in the eurozone and the corresponding European sovereign debt crisis the following year. The subsequent bailouts led to a devaluation of the euro while the crisis exposed many of the underlying structural problems with the euro; namely how when one nation defaults the whole bloc becomes exposed to instability. All of this led to a loss of investor confidence in the euro and a reduced role for the single European currency as a result.

The dollar is artificially overvalued as a result of its oversized role in the global economy. All this liquidity raises the value of the U.S. dollar and the result is an overvalued dollar that is strong not because of either innovative industry, productive capacity or market competitiveness, and certainly not because of the fiscal discipline of the Federal government, but because of the sheer volume of trade that takes place in the U.S. dollar. Additionally, there are many that feel that the strong dollar has played a major role in hollowing out American industry and manufacturing. The strength of the dollar has made American exports less competitive in global markets and American industry and workers have suffered as a result.