Empire of Dollars 7

The dollar weapon (2 of 2)

Part two of the dollar weapon will look at the role of sanctions, subsidies and what happens when the Federal Reserve floods the global economy with cheap liquidity. For the United States, weaponization of the dollar does not involve body bags and military funerals, bullets or missiles. For other countries, owing to the central position of the U.S. dollar in the global economy, a sanction from the dollar is a defacto global sanction as being cut off from the dollar makes it hard for your central bank, your companies and banks.

Subsidies

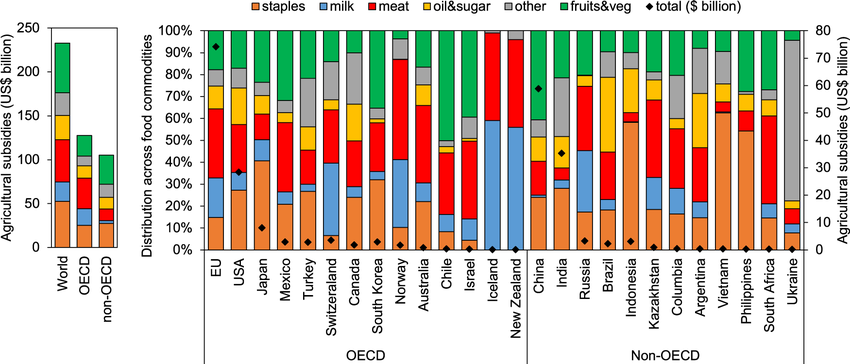

The enormous agricultural subsidies that the United States government grants to its domestic agriculture market (particularly to agricultural companies) is one of the most potent expressions of the dollar weapon. The effects of these subsidies often means that international farmers simply cannot compete with the artificially low cost of U.S. products. This can happen when the Federal Reserve reduces the cost of borrowing and the domestic market is flooded with cheap credit. Subsidies drive down crop prices worldwide, non-subsidised producers from the developing world cannot compete with the artificially low price of these crops and this can lead to an increase in poverty as a result. In the case of Jamaica, the country was prohibited from baring American sugar, grain and other crops from entering its markets, IMF policies directed Jamaica to keep tariffs low and domestic producers could not compete, they were effectively driven out of their own market by artificially cheap imports from abroad.[1] Haiti is another good example where, in this case, subsidised American rice displaced domestically grown rice and Haiti’s farmers, who do not have access to subsidies were again unable to compete.[2] At the 2006 Doha round of WTO trade negotiations, the U.S. refused to cut subsidies so that agricultural exports from non-subsidised countries could be more competitive.[3]

The graph above illustrates that the U.S. and the EU provide the greatest amount of subsidies to their agriculture sectors, far and above the average for non-OECD countries whose economies are more dependent on agricultural exports.[4] Ultimately, it is hard to avoid the fact that subsidies drive inequality, increase poverty and polarise markets. Furthermore, the U.S. will use the World Bank and the IMF to pressurise other countries to remove or reduce subsidies for domestic producers meanwhile the American government is very liberal with the use of subsidies for its own producers.

Dollar liquidity swap lines and adding liquidity to the global economy

Central banks swap lines were first pioneered in the 1960s to keep the Bretton Woods system afloat. A dollar liquidity swap line is basically a line of cheap credit issued by the Federal Reserve, done primarily to liquify financial markets. Using artificial money, the Federal Reserve bails out the banks and keeps financial markets solvent. Washington can decide who receives dollar liquidity swap lines and, perhaps more importantly, who does not. In return, these central banks are expected to be more accommodating to the Federal Reserve, U.S. banks and other American financial institutions.[5] This also significantly enhances the dollar’s position as the world reserve currency. Dollar liquidity swap lines were used in response to the 2008 global financial crisis when the ECB (European Central Bank), Bank of England, Bank of Japan, Swiss National Bank and other central banks of countries in the American imperium all received swap lines. In the aftermath of the 2008 crisis, the Fed actually made a $4 billion profit through the various swap lines, rather ironic considering the crisis originated in the U.S.[6] Swap lines were employed again during the COVID-19 recession in 2020.[7] Wikileaks cables confirmed the highly political nature of swap lines, with the U.S. being generous to other developed countries (those considered within the American imperium) but far less accommodating to emerging market economies and those in the global south, among these were Chile, Peru (a country with an excellent track record on debt and inflation), Indonesia, the Dominican Republic and India (an important geopolitical ally of Washington’s).[8]

What happens when the Federal Reserve floods the global economy with cheap money?

When the Fed floods the market with cheap liquidity by lowering interest rates emerging markets see a flood of inflows which complicates their battle with inflation and fuels commodity price surges and creates dangerous asset bubbles. This is because, amidst an inflationary environment, commodities are seen as safe assets because they retain their value so investors rush to purchase them. Initially, this is beneficial to commodity exporters but high prices will eventually lead to falling demand. Also, the increase in food prices tends to cause problems (food is included among commodities) for many emerging market economies. Generally speaking, food takes up a much higher percentage of household income for poorer countries than richer ones.[9]

As previously discussed in part one of the dollar weapon, when the U.S. floods the global monetary system with money this can lead to large fluctuations in currencies and countries are faced with two undesirable options: they can either let their currencies appreciate against the dollar or they have to invest in sizable amounts of U.S. Treasury debt in order to prevent the appreciation and protect their currencies. If their currencies rise in value against the dollar that will make their exports more expensive, a situation best avoided for obvious reasons.

Sanctions

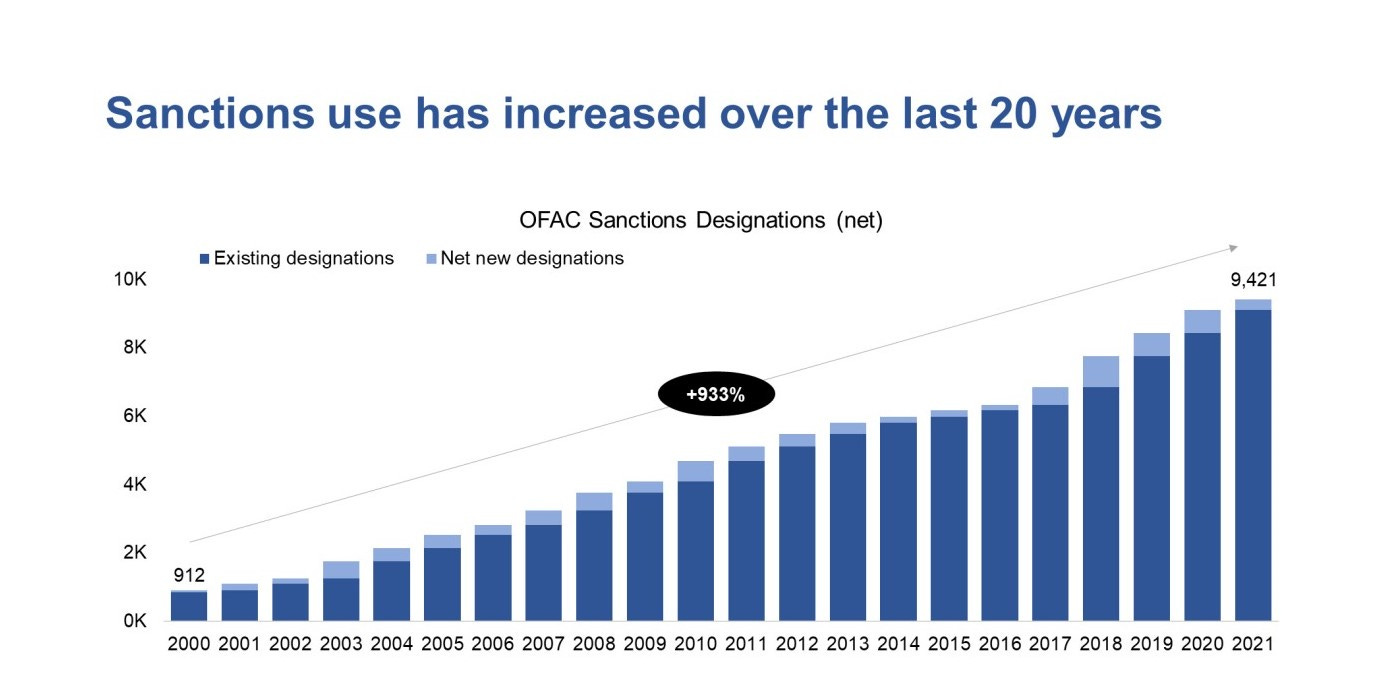

Sanctions are simply war by another means. In recent years the U.S. has used sanctions against many countries, including: Iran, Russia, Syria, Venezuela, Cuba, North Korea and more. Simply put, if you process your transactions using the dollar, the U.S. can sanction you or freeze your assets at any time. Almost all trade done in U.S. dollars, even trade among other countries, can be subject to U.S. sanctions, because they are handled by so-called correspondent banks with accounts at the Federal Reserve. Nations that openly challenge American interests, and American hegemony more broadly, are cut off from vital organs of the global economy and are subject to ongoing embargos, boycotts, tariffs and more. In fact, since 2000, U.S. sanctions globally have increased by more than 900% according to some estimates.[10] Sanctions are incredibly contentious because many feel that ultimately, they punish the people more than the government. It also needs to be mentioned that, in many instances, American sanctions are often followed by sanctions from the UK and the EU as well.

Legislation such as the International Emergency Economic Powers Act, the Trading With the Enemy Act and the Patriot Act allow Washington to weaponize payment flows.[11] After sanctions have been implemented, any dollar payment that goes through a U.S. bank or the American payments system allows the U.S. to prosecute the offender or act against its American assets. Sanctions take a variety of forms, including trade restrictions, asset freezes and seizures, travel bans, arms embargoes, capital restrictions, financial transactions, tariffs, aid reductions and more.

In many cases, if a foreign company tries to conduct trade with a company or organisation from one of the sanctioned countries then that company gets punished. For example, if Bayer (German), GlaxoSmithKline (British) or Danone (French) attempt to trade or do business with a sanctioned country then they risk being prosecuted by the U.S. In 2015, the French bank BNP Paribas was given a record penalty of nearly $9 billion, they had violated U.S. sanctions by processing dollar payments from Cuba, Iran and Sudan.[12]

In response to the Russia-Ukraine war, the U.S. froze $300 billion of Russian assets (almost half of its total reserves) and removed Moscow from the SWIFT payment system. Sanctions against Russia have targeted the country’s gas, oil, precious metals, banks and financial network, high net-worth individuals, military contractors, energy companies and more. Since the invasion of Ukraine in February 2022, America and its allies have placed more than 18,000 sanctions on Russia.[13]

Sanctions against Cuba began in 1960 and have left Havana incredibly isolated, leading to a range of devastating consequences with poverty, malnutrition and disease all having increased significantly.

However, no country has been sanctioned as heavily as Iran. Sanctions from the U.S. have impacted every level of Iran’s industry, economy and life including steel, oil, banking, pharmaceuticals, mining, coal, aviation, construction and much more. The penalties include a 20-year jail sentence and a $1,000,000 fine even if the accused are not American. Many types of dollar transactions are subject to these sanctions, along with the dollar’s central position in the global economy this means that Iran is one of the most isolated countries in the world as result. According to the National Foreign Trade Council, the sanctions are said to be worth around $61 billion annually to Iran’s economy, roughly 32% or Iran’s GDP.[14] Former Iranian foreign minister Javad Zarif has called the sanctions “economic terrorism”. When President Trump scrapped the Iran nuclear agreement, the sanctions placed on Iran were some of the most stringent to date, isolating it even further.[15] They complicated its battle with the COVID-19 pandemic, leaving Tehran unable to bring in enough vaccines and, furthermore, with the U.S. blocking a $5 billion loan from the IMF.[16] Being unable to use a payment system, Iran faces acute shortage of drugs for the treatment of around 30 illnesses.

Notes

[1] Why U.S. farm subsidies are bad for the world (no date). https://web.archive.org/web/20070609232802/http://www.commondreams.org/views02/0506-09.htm.

[2] Trade Liberalization and Globalization: The Experience of Haiti - ProQuest (no date). https://www.proquest.com/docview/305170611.

[3] US blamed as trade talks end in acrimony (no date). https://www.ft.com/content/dfa460d0-1afd-11db-b164-0000779e2340.

[4] Overview of agricultural support measures in 2017, including major... (no date). https://www.researchgate.net/figure/Overview-of-agricultural-support-measures-in-2017-including-major-spenders-and-the_fig1_357720800.

[5] Prasad, E. S. (2014). The Dollar Trap. Princeton University Press. p.202

[6] Prasad, E. S. (2014). The Dollar Trap. Princeton University Press. p.207

[7] Prasad, E. S. (2014). The Dollar Trap. Princeton University Press. p.128

[8] Prasad, E. S. (2014). The Dollar Trap. Princeton University Press. p.208-9

[9] Prasad, E. S. (2014). The Dollar Trap. Princeton University Press. p.142-3

[10] The Treasury 2021 Sanctions Review (2021) http://www.treasury.gov. U.S. Department of the Treasury. https://home.treasury.gov/system/files/136/Treasury-2021-sanctions-review.pdf.

[11] Bloomberg (2018) 'How the US has made a weapon of the dollar,' The Economic Times, 7 September. https://economictimes.indiatimes.com/news/international/business/how-the-us-has-made-a-weapon-of-the-dollar/articleshow/65715068.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst.

[12] Masters, J. (2019) 'What are economic sanctions?,' Council on Foreign Relations, 12 August. https://www.cfr.org/backgrounder/what-are-economic-sanctions#chapter-title-0-8.

[13] https://www.castellum.ai/russia-sanctions-dashboard

[14] Dean A. DeRosa & Gary Clyde Hufbauer, "Normalization of Economic Relations", National Foreign Trade Council, 21 November 2008

[15] Timeline of U.S. sanctions (2024). https://iranprimer.usip.org/resource/timeline-us-sanctions.

[16] Motamedi, M. "Iran's top banker says US blocking COVID-19 vaccine purchase". aljazeera.